Immunologists are well-paid compared to other professions, especially if they specialize: they earn around $275,000 a year in the US.

They aren’t on the top of the list compared to medical professions, but at least 54% of immunologists are happy with their payment.

This guide will show you how much you can expect to earn from residency to full-time employment.

Key Takeaways

- Immunologists in the U.S. earn an average salary of $275,000-$363,000 annually.

- Factors like experience, location, and practice type significantly influence salary levels.

- Subspecialization (e.g., pediatrics) or private practice can boost earning potential further.

- Student loan repayment options, including PSLF and income-driven plans, ease financial burden.

Table of Contents

What is the Average Immunologist Salary in the United States?

According to Medscape’s 2024 Physician Compensation Report, immunologists or allergists earn an average of $363,000, which is 3% higher than the previous year’s $352,000.

However, these are the general numbers. If we want to be more specific, PCPs earn an average of $277,000 per year, while specialists earn $394,000.

Currently, of all medical specialties, immunologists are the 8th from the bottom regarding payment. Yet, 54% feel that they’re adequately compensated, putting them at the 8th spot again, but this time from the top at the “happiness with the pay” scale.

Here are the average salaries from other trusted sources:

- Salary.com (2024): $283,000

- Glassdoor (2024): $267,000

- ZipRecruiter (2024): $236,601

- Payscale (2024): $90,000 (without any bonuses or incentives)

With the exception of payscale, all sources seem to agree that the national average salary for immunologists ranges between $270,000 and $280,000.

Men continue to earn more than women in 2024. No official data was released for the year, but the 2023 Medscape Report found a significantly high 19% payment difference ($386,000 to men compared to $300,000 to women). Still, that high gap is the lowest it has been in the past five years.

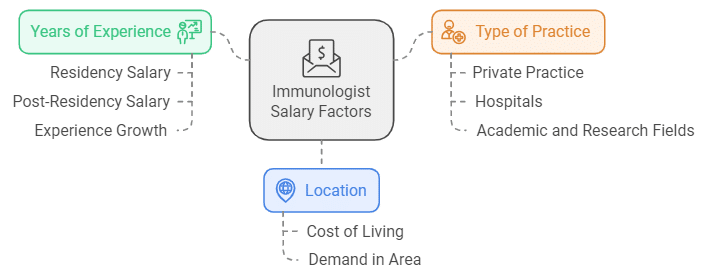

Factors That Affect an Immunologist’s Salary

Although salary reports seem pretty consistent across the board, there are ways to increase any physician’s market value.

How much can an immunologist make? The answer to that question is greatly dependent on these three factors:

1. Years of Experience

According to Medscape’s 2023 Residential Salary Report, residents earn around $61,000 in their first year, with the number increasing in increments until it reaches $74,000 in the last two years.

After an immunologist completes their residency, they can start out earning on the lower spectrum of the salary range, but this number quickly rises as they gain experience.

2. Location

It makes sense that an area with a higher cost of living would offer a higher salary for immunologist jobs, but the demand in the area also comes into play.

For example, the table below shows the top 10 states where immunologists earn the most.

Note: You’ll notice that the numbers are much lower than the average we mentioned earlier, but that’s because it’s the base salary without any bonuses or incentives.

|

State |

Annual Salary |

Monthly Pay |

Weekly Pay |

Hourly Wage |

|

Washington |

$85,395 |

$7,116 |

$1,642 |

$41.06 |

|

New York |

$76,882 |

$6,406 |

$1,478 |

$36.96 |

|

Vermont |

$75,348 |

$6,279 |

$1,449 |

$36.23 |

|

California |

$72,990 |

$6,082 |

$1,403 |

$35.09 |

|

Massachusetts |

$71,360 |

$5,946 |

$1,372 |

$34.31 |

|

Maine |

$71,056 |

$5,921 |

$1,366 |

$34.16 |

|

Alaska |

$70,762 |

$5,896 |

$1,360 |

$34.02 |

|

Pennsylvania |

$70,420 |

$5,868 |

$1,354 |

$33.86 |

|

Idaho |

$69,994 |

$5,832 |

$1,346 |

$33.65 |

|

Oregon |

$69,824 |

$5,818 |

$1,342 |

$33.57 |

On the other hand, these are the bottom 10 states where immunologists aren’t as well paid:

|

State |

Annual Salary |

Monthly Pay |

Weekly Pay |

Hourly Wage |

|

Oklahoma |

$59,872 |

$4,989 |

$1,151 |

$28.78 |

|

North Carolina |

$59,078 |

$4,923 |

$1,136 |

$28.40 |

|

Kansas |

$59,012 |

$4,917 |

$1,134 |

$28.37 |

|

Georgia |

$58,781 |

$4,898 |

$1,130 |

$28.26 |

|

Louisiana |

$57,639 |

$4,803 |

$1,108 |

$27.71 |

|

Michigan |

$56,707 |

$4,725 |

$1,090 |

$27.26 |

|

Kentucky |

$56,669 |

$4,722 |

$1,089 |

$27.24 |

|

West Virginia |

$54,386 |

$4,532 |

$1,045 |

$26.15 |

|

Arkansas |

$53,869 |

$4,489 |

$1,035 |

$25.90 |

|

Florida |

$52,021 |

$4,335 |

$1,000 |

$25.01 |

3. Type of Practice

The type of practice an immunologist works in is a huge determining factor in determining their potential earnings.

Many physicians strive to enter private practice. While this type of practice certainly has the highest earning potential, it can be risky for newer physicians.

Private practice is best for experienced immunologists who have already gained a large client base and are ready to take on more responsibility.

Hospitals have the biggest demand and easier placement, which makes it the best place for new immunologists.

Allergists and immunologists employed in the academic and research fields generally earn the lowest salary.

Research scientists, immunologists working in microbiology, and academic immunologists will earn less than $200,000, according to Recruiter.com.

Immunologists and Student Loan Debt

As immunologists and allergists attend medical school and earn their certification from the American Board of Allergy and Immunology, they rack up a large sum of student loan debt.

Knowing the best repayment options can make managing this financial responsibility much easier.

Our compensation specialists are trained to help immunologists and those with related jobs lift the heavy burden of student loan debt off their shoulders. They may be able to connect you with programs that can help you pay your loans back faster.

For example, those who have a direct loan or direct loan consolidation have the option to sign up for the Public Service Loan Forgiveness plan, which will require you to work full-time for a non-profit or government organization.

This plan requires you to make 120 consecutive on-time payments over the span of ten years, after which the remaining balance is forgiven.

Income-driven repayment plans are also popular with physicians. This category includes four options:

Learn more about your repayment options and talk to our team here.

Subspecialties for Immunology

While there are no official subspecialties offered in healthcare for the allergist/immunologist field, physicians can specialize in pediatric practice.

These pediatricians have the same job description as other allergists/immunologists, except they treat children instead of adults.

According to Salary.com, pediatric allergy and immunology jobs offer between $200,517 and $$275,481 in base salary for full-time employment.

How to Negotiate Your Immunologist Employment Contract

Negotiating employment contracts is part of the employment process for any physician. Many physicians dread this process and feel like a fish out of water.

Some physicians don’t even know how to read contracts or what a contract should include.

A complete employment contract should define the expected compensation and benefits, the physician’s duties and responsibilities, and the beginning and end dates of employment.

If there are future opportunities for partnership and ownership agreements, these should be laid out in the contract, and any restrictive covenants should be included.

Lastly, the contract should make clear any termination terms and insurance requirements.

Due to the complexity of physician employment contracts, many physicians choose to protect themselves legally and financially through a professional contract review.

This review should be done not only when entering or renewing an employment contract but also if the compensation package is being altered or you are renegotiating a contract to continue employment.

Another situation where many fail to use contract reviews for protection is when exiting a contract or when transitioning into a partnership from an employee position.

Reach Out Today

Physicians Thrive offers a full legal and financial contract review with unlimited access to a financial planner and licensed attorney throughout your entire negotiation process.

Contact our team before signing any employment contracts.

Subscribe to our email newsletter for expert tips about finances, insurance, employment contracts, and more!