Get a Quote

Get a Free Financial Planning Quote

Physicians Thrive offers specialized financial management services that address the unique financial challenges doctors face, such as high student debt, complex tax situations, and planning for a secure retirement.

We provide personalized solutions to help physicians achieve financial independence, optimize wealth, and build a stable future.

What is Financial Planning?

Financial planning involves creating a comprehensive roadmap to meet your financial goals. For physicians, this includes managing high incomes, tackling significant student loans, and planning for retirement.

Physicians face unique financial challenges due to prolonged education, student debt, and late career starts. A customized financial plan is essential to balance immediate needs and long-term goals.

- Manage High Student Loans: Develop strategies for repayment or forgiveness.

- Maximize Earnings: Optimize investment opportunities and retirement savings.

- Plan for Retirement: Ensure a secure future with structured savings plans.

Debt Management

Strategies to handle student loans and mortgages effectively.

Tax Optimization

Minimize tax burdens through tailored planning.

Future Security

Build a foundation for retirement and legacy goals.

Easily Measure and Assess Your Financial Health

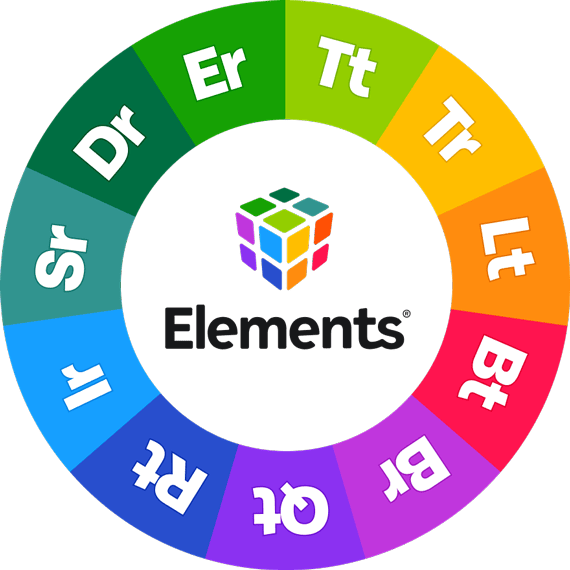

Physicians Thrive uses a financial planning system called Elements® to collect your financial information and measure the key indications for your financial wellness over time.

The Elements Financial Planning System™ gives us a real-time scorecard of your financial situation, so we can continually monitor your progress and provide ongoing, informed advice.

You can review these indications by exploring the Elements below:

- Are you taking the right amount of risk?

- Are you using your income wisely?

- Do you have the right mix of assets?

- How much wealth do you need to make work optional?

As we work together your financial plan will need regular course corrections to keep you on the right track.

That’s why each month we assess your overall financial health using the Elements scorecard and also focus in on one Element for which we collect updated data and do a deeper analysis.

Finally, we deliver beautifully designed, easy-to-follow reports that feature your very latest stats, scores, and any new recommendations for improving your plan.

This methodical approach to keeping your data up-to-date and refreshing your financial plan will give you complete confidence in your progress and direction.

1

Organize

Together, we’ll gather and organize your financial information upfront.

Then, our app will help keep your data up-to-date with prompts when things get stale.

2

Analyze

We’ll regularly analyze your financial health scores to identify ways to help you improve.

And each quarter we’ll deliver a report through our app that highlights all the progress you’ve made.

3

Decide

We’ll use your performance summary and progress report to help you decide if any adjustments should be made to your plan.

We’ll share recommendations with you by email, video, or phone.

4

Act

As the point person on your financial plan, your advisor will:

- Assign action items to our internal team

- Facilitate conversations with your other service professionals

- Introduce you to approved industry partners

Good to Know

Frequently Asked Questions

Explore essential answers to common financial planning questions for physicians.

What is a fiduciary relationship, and why does it matter?

A fiduciary is legally obligated to act in your best interests, ensuring unbiased advice tailored to your goals.

Should I pay off debt or invest first?

It depends on your interest rates and financial goals. A balanced approach often works best, tackling high-interest debt while investing for growth.

How can I save on taxes as a physician?

Use strategies like contributing to retirement accounts, leveraging tax-deductible expenses, and working with a financial advisor to optimize your tax situation.