Manage Your Money

Services • Financial Management

Strategy & Investments

Financial Management for Physicians

Physicians Thrive offers specialized financial management services that address the unique financial challenges doctors face, such as high student debt, complex tax situations, and planning for a secure retirement.

We provide personalized solutions to help physicians achieve financial independence, optimize wealth, and build a stable future.

How It Works

Effective financial management is key to building a secure and prosperous future.

Physicians Thrive tailors its services to the needs of medical professionals, offering comprehensive guidance in taxable investments and retirement planning.

From optimizing investment strategies to planning for a comfortable retirement, our team ensures your financial decisions align with your goals.

Let us help you take control of your financial journey and focus on what you do best—caring for your patients.

Taxable Investments

Maximize after-tax returns with strategic asset allocation, tax-loss harvesting, and capital gains management for sustainable wealth growth.

Retirement Planning

Build a retirement strategy that balances growth and stability, utilizing tax-advantaged accounts and tailored investment approaches.

Comprehensive Oversight

Align your financial management with broader goals, including estate planning, practice management, and tax efficiency, ensuring holistic success.

Easily Measure and Assess Your Financial Health

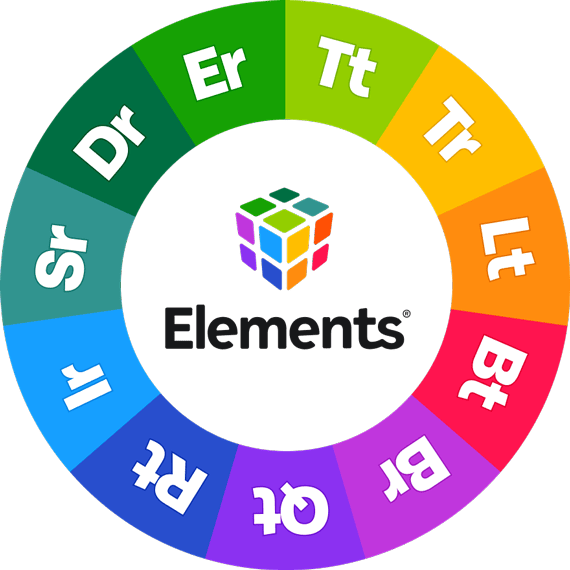

Physicians Thrive uses a financial planning system called Elements® to collect your financial information and measure the key indications for your financial wellness over time.

The Elements Financial Planning System™ gives us a real-time scorecard of your financial situation, so we can continually monitor your progress and provide ongoing, informed advice.

You can review these indications by exploring the Elements below:

- Are you taking the right amount of risk?

- Are you using your income wisely?

- Do you have the right mix of assets?

- How much wealth do you need to make work optional?

As we work together your financial plan will need regular course corrections to keep you on the right track.

That’s why each month we assess your overall financial health using the Elements scorecard and also focus in on one Element for which we collect updated data and do a deeper analysis.

Finally, we deliver beautifully designed, easy-to-follow reports that feature your very latest stats, scores, and any new recommendations for improving your plan.

This methodical approach to keeping your data up-to-date and refreshing your financial plan will give you complete confidence in your progress and direction.

1

Organize

Together, we’ll gather and organize your financial information upfront.

Then, our app will help keep your data up-to-date with prompts when things get stale.

2

Analyze

We’ll regularly analyze your financial health scores to identify ways to help you improve.

And each quarter we’ll deliver a report through our app that highlights all the progress you’ve made.

3

Decide

We’ll use your performance summary and progress report to help you decide if any adjustments should be made to your plan.

We’ll share recommendations with you by email, video, or phone.

4

Act

As the point person on your financial plan, your advisor will:

- Assign action items to our internal team

- Facilitate conversations with your other service professionals

- Introduce you to approved industry partners

What’s Included in Physicians Thrive Financial + Tax Planning

- Budgeting

- Employment and Partnership Assessments

- Education Savings Programs

- Compensation Benchmarking

- Income Statement and Balance Sheet Preparation

- Student Loan Management

- Annual Financial Reporting

- Credit Report Review

- Investment Portfolio Management

- Retirement Planning

- Tax Strategies and Filings

- Insurance Planning

- Residential and Commercial Real Estate Considerations

About Us

Get Information From a Trusted Source

What is a fiduciary when you are talking about financial planning? Not all advisors are fiduciaries. Advisors who act as fiduciaries are legally and ethically obligated to make recommendations in the best interest of the client. Our financial advising relationships are built around educating physicians on the strategies that become a part of their individualized plan.

Get Ongoing Service.

We are on call for our financial planning and tax clients. Physicians Thrive team of advisors are a resource for you during both your major and minor financial decisions. Our team is here to help you with anything and everything related to the dollar.

One way we are here to serve you is with an annual contract review. This includes contract renewal with the same employer or an employment offer from a new job opportunity, as well as a review of the annually updated MGMA compensation data with your advisor. Ensure your being compensated fairly as you advance in your career.

Frequently Asked Questions

What are taxable investments?

Taxable investments are assets held outside retirement accounts that generate growth or income. They offer flexibility and liquidity, essential for diversifying wealth and meeting both short- and long-term goals.

How does Physicians Thrive assist with retirement planning?

We provide tailored retirement plans, integrating tax-advantaged savings, diversified investments, and income strategies to ensure a secure financial future.

Can I integrate my taxable and retirement strategies?

Absolutely. Our experts align taxable investment strategies with retirement goals, optimizing tax efficiency and ensuring cohesive financial growth.

Is there a fee for an initial consultation?

There is no fee for the initial consultation or even for the discovery phase of developing your plan. We want you to feel confident that your advisor is the right person to help you set and reach your goals. The initial meeting is for us to learn more about your unique financial situation and for you to learn more about what financial planning is like with Physicians Thrive.

There is no fee during the discovery phase. After the discovery phase is completed and a plan has been developed for your specific needs, your advisor will present you with an agreement outlining the scope of your financial plan. You will not be charged until this agreement has been signed.

Here’s what you can expect as a part of the Physicians Thrive financial planning discovery process:

Evaluating if Physicians Thrive is the right fit for you and vice versa

Determining the your goals

Engaging in multiple meetings for the advisor to learn about your s concerns and motives

Gaining an understanding of your expectations

Is Physicians Thrive a Registered Investment Advisor (RIA)?

Yes Physicians Thrive is a RIA and out advisor act Investment Advisor Representatives (IARs)

Are your services “fee-based”?

Yes, Physicians Thive has a fee based financial planning model. Our advisors charge a fee for developing and managing financial plans.

Do the advisors at Physicians Thrive seek additional compensation from other services?

Advisors receive reimbursement from life and disability insurance sales but as a fiduciary they only make recommendations based on the clients needs.

This works similarly to the way a physician is reimbursed by an insurance company for various procedures a patient may need.

How do I pick a financial advisor?

Above all else, work with someone you trust. We recommend you work with a fiduciary. With the help of an advisor who functions as a fiduciary, you get a transparent expert that is able and willing to explain their strategy with you on how they plan to invest your money.

A good advisor will give you the opportunity to meet for no costs in an introductory or discovery meeting to understand if it’s a good fit for both parties. The initial conversation should be a two-way interview to help each party evaluate each other. Here are some questions to ask yourself and/or your advisor:

Is there a value alignment between you and the advisor?

Are they qualified to provide the advice you’re looking for?

Do they have experience with clients in similar situations?

Do they have the resources within their team to meet the needs of your situation?

Is my advisor a fiduciary?

Yes, all Physician Thrive advisors are fiduciaries.

Does Physicians Thrive offer tax preparation services?

Yes. Physicians Thrive has a dedicated team of tax professionals who understand the more complex financial situations many physicians find themselves in.

What should I expect from a financial advisor?

You should receive advice based on your specific goals and what is most important to you. A good advisor will not provide you a one-size-fits-all solution but will give you individualized strategies based on your exact situation.

How often will I meet with my financial advisor?

The discovery portion of developing a plan usually takes 2-4 meetings to discuss your current situation and establish recommended strategies. When onboarding a new client, we typically will meet several times a month for 30 to 60 minutes.

Once your plan is put in place, it’s up to you how often you would like to meet. Our team recommends meeting with your advisor once a quarter at the minimum.

Each client schedule and needs are different, our team strives to communicate with each physician’s preferred amount and method (whether it’s over the phone, video call, text, or email). We understand that physicians have busy schedules, we’re available nights and weekends

For physicians needing tax planning services, we recommend meeting twice a year; 1) to file your taxes, and 2) to develop a tax plan before the new year before the first quarter (October 1).

Related Services

110,500 Physicians

…and Counting

We’ve educated and served thousands of physicians.

Our team has helped physicians in all 50 states better understand their unique financial situations.

7,000+ satisfied physicians