Key Takeaways

- Cardiothoracic surgeons earn an average of $530,400 annually, with significant salary variation.

- Factors like experience, location, and practice type impact earnings; private practice often pays more.

- Subspecialties like pediatric cardiac surgery can exceed $630,000 annually, boosting earning potential.

- Negotiating contracts, optimizing tax strategies, and retirement planning maximize long-term financial benefits.

Cardiothoracic surgeon salaries can fluctuate greatly. For example, the reported salary on ZipRecruiter is $367,474, which is much lower than Payscale’s $421,116.

Many factors in the U.S. healthcare system can affect the cardiothoracic surgeon salary. In this guide, we’ll give you the most accurate estimations to date, as well as what you can do to maximize your earnings.

We’ve helped over 20,000 physicians negotiate for the salaries they deserve. Are you getting paid enough? Talk to one of our contract review specialists today.

Table of Contents

What Is the Average Cardiothoracic Surgeon’s Salary?

According to Medscape’s 2024 Cardiologist Compensation Report, cardiologists average is $525,000 a year (3%+ compared to last year, which is the third on the list right after orthopedics and plastic surgery.

As of 2024, 58% of the cardiologists in the United States are women, yet there’s still a significant payment gap.

Keep in mind that cardiologists and cardiothoracic surgeons are not the same and that cardiothoracic surgeons, in particular, weren’t mentioned in Medscape’s 2024 or 2023 report.

However, we do have four other sources that mention cardiothoracic surgeons, with salary.com being the most accurate (and fairly closer to Medscape in most cases).

- Salary.com (2024): $530,400

- Payscale (2024): $421,116

- Glassdoor (2024): $338,000

- ZipRecruiter (2024): $367,474

The large discrepancies in payments amongst these sources are because of how they measure the salary. For example, ZipRecruiter and Glassdoor don’t take sign-in bonuses or incentives into consideration, which leads to a lower average.

Male PCPs make $295,000 compared to women’s $253,000, and male specialists make $435,000 compared to female specialists who make $333,000. That’s a massive $102,000 difference.

Related:Surgical Resident Salary: How much do they make?

Factors That Affect a Cardiothoracic Surgeon’s Salary

The salary range of any surgeon can be affected by a variety of factors, such as how long they’ve been practicing and who they work for. Let’s look deeper at these factors:

Years of Experience

Before even entering the workplace, a cardiology resident earns $61,000 in their first year, with an increase each year of residency after that, according to Medscape’s 2023 Resident Salary and Debt review.

The expected pay for cardiothoracic surgery increases with experience, but it is also greatly dependent on the type of practice with which a surgeon is affiliated.

According to Salary.com, the annual salary of an entry-level cardiothoracic surgeon increases within the first five years but caps off around $485,867.

Location

The fair market value of a cardiothoracic surgeon is dependent on the cost of living and the current demand in the area of practice. When the cost of living is higher, the expected pay also increases to help pay for that cost.

Healthcare companies will offer a more competitive wage to attract applicants when the area has a high demand for surgeons.

Here are the top 10-paying states where cardiothoracic surgeons are best paid (once again, these are only the base salaries, so they’re below Medscape’s average):

|

State |

Annual Salary |

Monthly Pay |

Weekly Pay |

Wage per Hour |

|

New Jersey |

$396,937 |

$33,078 |

$7,633 |

$190.84 |

|

Wisconsin |

$388,388 |

$32,365 |

$7,469 |

$186.73 |

|

Washington |

$383,377 |

$31,948 |

$7,372 |

$184.32 |

|

Massachusetts |

$382,798 |

$31,899 |

$7,361 |

$184.04 |

|

Alaska |

$382,625 |

$31,885 |

$7,358 |

$183.95 |

|

Oregon |

$380,262 |

$31,688 |

$7,312 |

$182.82 |

|

North Dakota |

$379,382 |

$31,615 |

$7,295 |

$182.40 |

|

New Mexico |

$373,423 |

$31,118 |

$7,181 |

$179.53 |

|

Hawaii |

$371,918 |

$30,993 |

$7,152 |

$178.81 |

|

Minnesota |

$369,715 |

$30,809 |

$7,109 |

$177.75 |

Alternatively, here are the lowest-paying states:

|

State |

Annual Salary |

Monthly Pay |

Weekly Pay |

Wage per Hour |

|

North Carolina |

$314,578 |

$26,214 |

$6,049 |

$151.24 |

|

Arizona |

$308,398 |

$25,699 |

$5,930 |

$148.27 |

|

Montana |

$303,751 |

$25,312 |

$5,841 |

$146.03 |

|

Kentucky |

$303,370 |

$25,280 |

$5,834 |

$145.85 |

|

Michigan |

$302,323 |

$25,193 |

$5,813 |

$145.35 |

|

Alabama |

$299,959 |

$24,996 |

$5,768 |

$144.21 |

|

Arkansas |

$287,731 |

$23,977 |

$5,533 |

$138.33 |

|

Georgia |

$279,438 |

$23,286 |

$5,373 |

$134.35 |

|

West Virginia |

$256,846 |

$21,403 |

$4,939 |

$123.48 |

|

Florida |

$247,306 |

$20,608 |

$4,755 |

$118.90 |

Source: ZipRecruiter (2024)

Type of Practice

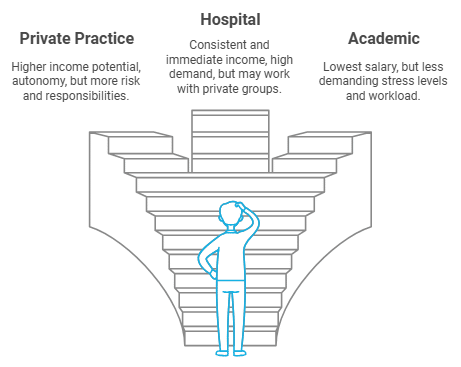

There are several different types of practices in which heart surgeries are involved.

Although every surgeon performs duties in the operating room, the type of practice they work in can significantly affect the amount they take home at the end of the week.

Private Practice Salaries

Salary possibilities depend on whether a heart surgeon works in a multi-specialty, single-specialty, or solo practice.

In group practices, salaries vary based on whether the total compensation is guaranteed or based on some form of productivity benchmarking system.

There is a possibility of more income if you buy into the practice. Of course, if you own your practice, you have the autonomy to make business decisions and, therefore, choose your salary. But this also means that you carry more risk and responsibilities.

Hospital Salaries

Hospital positions often have the highest demand and easiest placement. These jobs and related jobs provide consistent and immediate income. However, many hospitals work with private groups to care for their surgeries.

Academic Salaries

A cardiothoracic surgeon working in an academic or research setting will earn the lowest salary for this job title, but the stress levels and workload are much less demanding.

Cardiothoracic Surgeons and Student Loan Debt

It’s no secret that medical school is costly. In fact, many doctors spend a large portion of their early career struggling to pay off that enormous debt.

Those who plan to go into a high-paying field like cardiothoracic surgery tend to accumulate even more debt due to the added level of education.

There are many different payback options, including income-based repayment, pay-as-you-earn, revised pay-as-you-earn, and income-contingent repayment.

Determining which repayment plan is the best for your circumstances can be puzzling. If you are having difficulty deciding between repayment options, our financial specialists are here to help.

You can also learn much more about medical student loans and the ins and outs of how to pay them off as quickly as possible when you read our Full Breakdown of Medical School Loans.

Subspecialties for Cardiothoracic Surgeons

Even in the highly specialized area of cardiothoracic surgery, there are three major subspecialty positions. Your subspecialty will affect your annual income.

General Thoracic Surgery

General thoracic surgeons work on heart-related procedures but specialize in the other organs in the chest cavity, as well.

According to Research Gate (based on MGMA data), they make an average of $429,923.

Congenital/Pediatric Cardiac Surgery

A pediatric patient carries a lot more risk compared to general surgery patients, which is why its average is considerably higher per year. According to MGMA, pediatric cardiac surgeons make $631,397 per year.

Transplant Cardiac Surgery

Cardiovascular transplant surgeons are a middle ground between the previous two specialties, making an average of $505,404 per year.

Building a Retirement From Your Annual Heart Surgeon Salary

The earlier you start saving for retirement, the better since the time value of money increases due to compound interest.

For the Employed Cardiothoracic Surgeon

Qualified retirement plans are tax-deferred savings plans for the employed cardiac surgeon to prepare for retirement. These include a 401k and a 403b.

A 401k is the plan offered by for-profit companies to their employees, while non-profit companies offer a 403b.

For Private Practice Cardiothoracic Surgeons

Qualified retirement plans for private practice cardiac surgeons also allow contributions to these savings plans to be tax-deductible.

We can break them down as follows:

Profit-Sharing Plans

This retirement plan divides a portion of the annual profits to each private practice partner and their employees to be deposited into their retirement fund.

Money Purchase Plans

This type of retirement plan is similar to the profit-sharing program, except that instead of being dependent on profit, they use fixed portions.

Defined Benefit Plans

They create defined benefit plans using a formula outlined by the practice based on factors they have defined.

These plans normally have a predetermined amount of time that needs to be reached before you can access the funds.

You can also offer a 401k like other companies and non-qualified retirement plans that can hedge against the qualified retirement plans you have. Non-qualified retirement plans are not tax-deductible.

For Both

Both employed and private practice surgeons can use traditional IRA and Roth IRA plans to help them progress toward retirement. However, they have to follow the current rules that have restrictions on how you can fund them based on income limits.

Some other viable options are to make investments that provide recurring income to add to your retirement funds. An excellent example of this would be to purchase some profitable rental real estate.

Related: Why Doctors Should Consider Real Estate Investing

Effective Tax Planning for Cardiothoracic Surgeons

Tax season is a dreaded time for physicians since they must pay such a high amount of their hard-earned money to the IRS.

However, cardiothoracic surgeons can save thousands of dollars over the span of a few years with the help of a tax professional.

Some (but not all) tax professionals know the complicated ins and outs of the tax code and can find money-saving moves specific to your situation.

Get a free tax return review from our team of compensation specialists to check for tax deductions, credits, and potential errors that you might have missed. Our goal is to keep as much of your money in your pocket as possible.

Final Words

There are many variations in salary from one heart surgeon to another. Earning at or above fair market value requires knowledge of all the facets listed in this article.

When it comes to negotiating your employment contract, you may be willing to give up a little income for certain benefits, especially if they hold more value for you personally.

Gaining income and protecting that income can seem like a daunting task, given the complexity of the medical business. We’re here to help. Give us a call and talk to one of our compensation specialists today.

Subscribe to ouremail newsletter for expert tips about finances, insurance, employment contracts, and more!