You don’t have to be an economist or have studied macroeconomics in college to know that inflation is a dirty word. With inflation comes the higher costs of products and services, while at the same time, the value of our money lessens.

From 1990 to 2018, the average inflation rate in the United States was 2.46% per year. In other words, items that cost $100 this year will cost $102.46 next year, and so on, and so on …

And with inflation comes the inflation tax, which can affect your long-term savings accounts and retirement plans. Fortunately, with some strategic investing and proper retirement planning, there are ways to reduce your inflation tax.

Ready to learn what the inflation tax is all about? Want to know how you can avoid it? Here’s everything physicians need to know about the inflation tax.

Table of Contents

What is Inflation Tax?

Let’s be clear; the inflation tax is not an actual tax like income tax or sales tax. It is not related to your income tax rate. It has nothing to do with tax revenue.

There is no line on your 1040 tax form that forces you to pay an additional two or three percent of your earnings because of inflation. There’s no outright penalty that you have to pay or payment that you have to make to account for rising inflation rates.

The inflation tax is unseen.

And that’s why it’s so complicated and tricky for some people to navigate and plan for.

The inflation tax is a penalty on the cash you hold as the rate of inflation rises. As inflation rises, cash becomes less valuable.

For example, let’s say you tucked away a $100 bill at the end of last year in order to buy a $100 product this year. Because of inflation, that product now costs $102.46. But that cash in your pocket is still $100 — it hasn’t grown or earned interest. So, you’ll need to cough up the additional $2.46 as a sort of penalty for not buying that product last year.

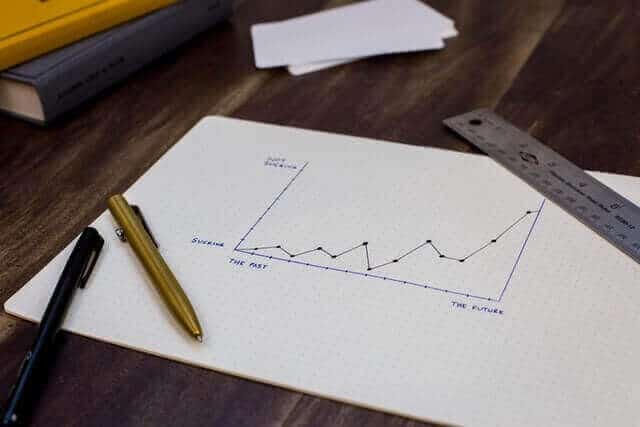

In short, the cash you save today will be worth less tomorrow.

The inflation tax only affects cash holdings and liquid assets. It does not affect securities or real estate investments. So if you want to avoid the inflation tax as much as possible, you’ll need to put your money into various investment vehicles rather than hoarding it all in liquid assets.

You may also like our Essential Elements of Financial Planning guidebook.

How Does the Inflation Tax Work?

While the inflation tax varies from year to year, you can be sure that it will hit you to some degree. And the more cash and liquid assets you have, the harder it will hit you.

Here’s how it works:

You have a cash savings account earning 2% in interest. Inflation rises at 4% for the year. Do the math: you’ve just lost 2%. You could have gained 2%, or even more, if you had put your cash into other investments, such as stocks or other securities.

It’s always best to have a financial planner and investment advisor guide you into diversifying your investments to reduce your inflation tax. But if you want to have real control over your retirement plans and investments, it’s essential to understand how inflation works.

What Causes Inflation?

Several things contribute to rising inflation:

One way is seigniorage, which means the government prints and circulates more money into the economy. The higher the money supply, the higher inflation tends to be. The government can also increase inflation by reducing interest rates that, in turn, add cash into the market.

Another way inflation occurs is when raw materials and labor wages increase, forcing manufacturers to increase the cost of goods.

Economic activity is another reason for inflation, particularly when there is more demand for products than supply. When the demand for a product is higher than the supply, people are often willing to pay a higher price level for it.

The Federal Reserve Has the Control

Central banks, including the U.S. Federal Reserve, monitor fiscal policy and inflation from year to year and have an optimal inflation rate of 2% per year. Depending on how fast inflation rises, the Federal Reserve adjusts its monetary policy year in correlation.

The Federal Reserve has the authority to change federal interest rates from year to year. Lower interest rates put more cash into the market, which makes inflation rise. Why? Because when lenders offer lower interest rates, borrowers are more likely to seek loans and put more money into the economy.

Cutting interest rates benefits borrowers, but maintaining a low annual inflation rate has a different type of benefit: it helps the exchange rate and makes U.S. currency more valuable overseas. This helps to maintain a balance of international trade and spur economic growth.

In the U.S., we have countermeasures to combat the effects of hyperinflation. In countries with banking systems that do not combat inflation, high inflation rates reduce tax revenues, increase government expenditures, and cause bigger government budget deficits.

The bottom line is this: you are powerless against the inflation rate or inflation tax. But you can control how and where you put your money to avoid it as much as possible.

See also: The Complete Guide to Physician Retirement Planning

Develop a Diversified Retirement Savings and Investment Strategy

To combat the inflation tax, you’ll need to create a diverse investment strategy for your retirement. But there’s more to retirement planning than merely investing in 401ks and IRAs.

While those are excellent ways to save for your future, there are other ways to protect your retirement income against inflation.

Invest in Stocks, Bonds, and Commodities

Investing in stocks and commodities is one of the best ways to protect your assets against the inflation tax.

Stocks pay dividends, and those dividends tend to increase as companies earn more money and increase their stock prices. Stocks on the S&P yield an average of 13.6% annually, much higher than the typical inflation rate of approximately 2%.

Also, the stock market tends to grow higher over time. Even if your stocks grow at the same rate as inflation rises, the value of those stocks will net you more wealth than if you had your money in a cash account.

Bonds are also important, as they provide fixed rates and protect against potential stock market decreases. Buying short term bonds can put you in an even better position because as inflation rises, so do the interest rates paid on bonds. As your short term bonds mature, you can put those proceeds into new bonds that offer a higher interest rate.

Commodities are also vital in hedging against the inflation tax. Commodities, such as gold, oil, and beef, tend to do well, despite rising inflation rates.

Invest in Real Estate

Real estate prices almost always increase faster than the inflation rate, though they don’t provide nearly as much return on your money as stocks and commodities investments. If you don’t want to invest in more property, consider buying stocks in real estate companies or real estate investment trusts (REIT).

When people talk about the return on real estate investments, there are two different rates that they refer to: real interest rates and nominal interest rates.

Nominal interest rates refer to the interest earned without taking inflation into account. Real interest rates take inflation rates into account. At the time of this writing, the average real interest rate on home values is approximately 1.5% a year.

Related: 5 Ways for Doctors to Save on Taxes

Invest in Yourself

Rather than stashing tens of thousands of dollars of cash into a low interest-bearing savings account, you can spend that money better by investing in yourself.

Get an additional degree. Get more certifications in your medical specialty. The more advanced your education and experience is, the more money you can command in salary per year.

You can then take that salary increase and put it into stocks, commodities, real estate, and other investment vehicles for real output.

Protect Yourself With an Inflation Hedge

An inflation hedge is any investment that protects against decreased purchasing power. In other words, as the value of cash decreases, inflation hedge investments can maintain their value and potentially increase their value over time.

In simple terms, an inflation hedge offsets losses and drops in currency value. There is no guarantee that the stocks you own will outperform the rate of inflation, so inflation hedging is a smart way to guard against that decrease of value.

Buy Treasury Inflation-Protected Securities

Treasury Inflation-Protected Securities, also called TIPS, are treasury bonds explicitly designed to protect you against the inflation tax. In fact, these securities rise and fall along with inflation. They are issued by the U.S. government and adjusted based on the current Consumer Price Index and the current inflation rate.

TIPS are government bonds backed by the federal government, so they are considered low risk. They are issued with maturities that range from five to thirty years. At the point of maturity, TIPS pay the investor a minimum of the original principal. You may not gain, but you won’t lose.

Take Advantage of Inflation Derivatives

Another way to protect yourself against the inflation tax is to hedge your investments with inflation derivatives. Inflation derivatives refer to a variety of different investment strategies, one of which is the inflation swap.

An inflation swap is a contract that allows an investor to make a fixed payment to protect against inflation risk.

Ways to Avoid the Inflation Tax

The inflation tax is unavoidable, but there are some ways to reduce that “tax liability” and make your money as valuable as possible in retirement.

Put Your Cash Savings into a Roth IRA

Traditional, SEP and Simple IRA withdrawals are taxable income, but you can make contributions to IRA accounts tax-free via the back door method. The money in your account also grows tax-free.

An IRA alone won’t protect you from the inflation tax, but it is a crucial component of your overall retirement plan.

In the current tax year, the more money you contribute to your 401k, the less you’ll pay in federal income taxes. Reducing your taxable income means having more money in your pocket that you can contribute to other investment vehicles.

Max Out Contributions to Tax-Deferred Compensation Plans

Do you have the option to put earnings into a tax-deferred compensation plan? Like a 401k plan, you’ll pay taxes when you withdraw your money in retirement, but you can contribute to the plan in a tax deductible manner.

It may be worthwhile for physicians to consider some form of a traditional retirement savings plan, and deferred compensation plans, such as the 457b, as they may be a great compliment to invest your money tax-deferred.

As with the 401k, contributions to a tax-deferred compensation plan allow you to reduce your income tax base.

Diversify Your Investments

Do you have new money from a salary increase or other investments coming your way? Don’t put that cash in the bank; put it into investment accounts that diversify your portfolio.

You can choose stocks, bonds, and real estate. There are many ways to protect your income from inflation and build your long-term wealth for a better, more secure retirement.

Protect Your Retirement With the Right Insurance

Avoiding or reducing your inflation tax is only one component of creating a sound, healthy retirement plan. It’s also essential to have the key insurance policies in place to protect your future income, protect your assets, and protect your heirs and loved ones.

Disability Insurance

All physicians should have disability insurance. Should you become too sick or injured to work in your specialty, disability insurance will pay you a portion of your salary so that you can continue to cover your monthly expenses, contribute to retirement savings accounts, and grow your retirement funds.

To learn more about disability insurance, read our post on Group Disability vs Individual Disability Insurance for Physicians.

Permanent Life Insurance

Permanent life insurance is equally as important. When set up as an institutional non-qualified executive benefit plan, it can help you build long-term wealth by accumulating cash value that you can use to create tax free income in retirement and lower your overall effective income tax rate.

When all or the majority of your retirement savings are taxable, the income tax required from those distributions will be the largest tax bill you have to pay. You can mitigate this burden with a tax free income source.

For more details, check out our Term vs. Permanent: A Physicians Life Insurance Guide.

Physicians Can Protect Themselves Against Inflation

There are various tax-saving strategies that physicians can take advantage of to protect themselves against the inflation tax.

Speak to a specialized physician financial planner to discuss the effects of inflation and create a long-term plan that will help you avoid the inflation tax, build personal wealth, and protect your retirement.

The inflation tax is an unseen tax, but it is very, very real. As inflation rises (and it always does), the cash in your savings account today will be less valuable in twenty years.

Put your money into securities, commodities, real estate, TIPS, inflation hedge investments, and traditional retirement accounts. Speak to a specialized physician financial planner for guidance on how to maximize your assets and reduce your taxes.

Remember, the more liquid you are, the more of an inflation tax you’ll pay.

For more advice on tax planning and retirement savings strategies, contact Physicians Thrive now.