Protect Your Income

Disability Insurance for Physicians

As a physician, protecting your income with disability insurance is essential. Physicians Thrive provides tailored disability insurance quotes to help secure your financial future.

7,000+ satisfied physicians

Get one plan for your entire career.

With an individual disability insurance policy, you have coverage that remains the same from job to job without any extra work on your end.

The largest discounts are available to residents & fellows

The top insurance companies provide discount disability insurance quotes for training physicians and they last for the life of the policy-not just until graduation. There are not many chances to score discounts on true own-occupation disability insurance, so taking advantage of these discounts is a must.

$3.6 Billion

and counting…

We’ve Shopped Billions of Dollars in Coverage.

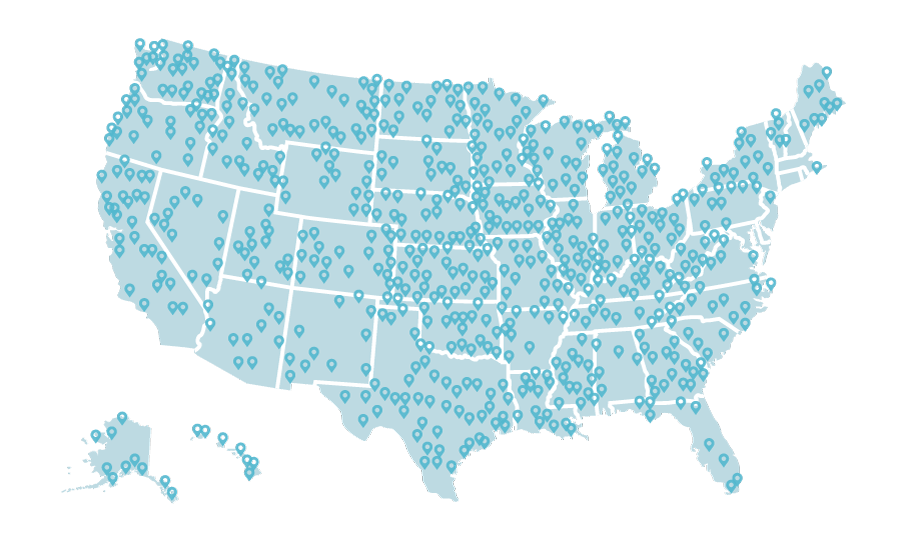

Our team has worked with thousands of physicians to weigh their options for disability insurance around the United States.

When you work with Physicians Thrive, we promise the best service for physicians.

See all your options.

Our experts present all the options—not just the ones we want you to choose—so the freedom to choose the best policy for you is always at your discretion. Plus, your insurance will follow wherever the job market takes you.

The best discounts.

When Physicians Thrive finds the lowest rate, you’ll know immediately so you can jump on exceptional insurance discounts.

Reliable coverage.

Our experts work with top disability insurance companies to get as many disability insurance quotes as possible so our clients never have to shop around—simply choose the option that works for you.

Now is the best time to buy disability insurance

You’re in your prime.

Disability insurance rates are based on your age and health so applying sooner than later can help you save. Each year you wait to apply you will pay between 5-7% more for the same coverage.

Your coverage will move with you.

Most new physicians switch employers multiple times within their first few years of training. With an individual disability insurance policy, you have coverage that remains the same from job to job without any extra work on your end.

We work with physicians at over 400 medical centers

Our team has worked with physicians from the top resident and fellowship programs in the world

Group vs Individual Plans

Employer-provided plans won’t give you the coverage you need in if you become sick or injured. Discover the major differences in coverage between group plans and individual plans in the chart below.

Employer Provided Disability Insurance

Group

There is no guarantee of coverage or policy renewal. Your employer can change your plan or cancel your coverage at any time

You don’t get to keep your coverage if you leave your current position

Any benefit received is taxed as ordinary income if provided by your employer

If you are working in any capacity your group plan may consider you no longer disabled and will stop paying you

Own Occupation Disability Insurance

Individual

Policies from independent carriers are non-cancellable and guaranteed renewable which means the company cannot cancel or change your policy.

You own your policy so it stays with you from job to job

Benefits are received completely tax-free

If you cannot do your primary duties your policy will pay you the full benefit. You will still have full freedom to work in any other capacity

Frequently Asked Questions

Why do you need disability and life insurance?

Life happens. We cannot predict the future, but we can be prepared for it. That is the purpose of insurance – to protect and provide for yourself and your loved ones if the unfortunate happens. Your life and disability insurance choices may make the difference in your family’s lifestyle after a tragedy strikes by paying the bills, financing children’s educations, and protecting your spouse’s retirement.

When is the best time to purchase a disability insurance policy?

Premium and policy eligibility are based on age and current health status. Therefore, the best time to seek disability insurance quotes and enroll in a policy is when you are young and healthy and while discounts are still available with residency or fellowship status. Additionally, many insurance carriers will restrict the amount of coverage you are eligible for if you have an employer-sponsored plan.

Which disability insurance carriers to do you work with?

Physicians Thrive only offers what we view as the strongest and most comprehensive physician-specific plans from the leading disability insurance carriers. We work with Ameritas, Guardian, Principal, MassMutual and The Standard. If you have pre-existing conditions that may result in high cost disability insurance quotes from these companies, we can help you find a GSI (Guaranteed Standard Issue).

What is the Comdex Ranking?

The Comdex is not a rating, but a composite of all ratings. It ranks companies on a scale of 1 to 100, showing you at a glance, where a company is ranked among all rated companies. The Comdex Ranking is not equated to a grading system such as 90% equals an A or 80% equals a B grade.

The Comdex Ranking is a relative number based on the following factors:

- If a company’s ratings from one of the ratings services AM Best, Standard and Poor’s, Moody’s or Fitch changes

- If one or more companies are added or removed from the list of insurers rated by the above rating services

- If another company with similar ratings, experiences a rating change, the percentiles or Comdex Ranking will adjust

For example, if 1000 companies are rated, a company that is rated in the top one hundred of these companies, and meet the criteria for Comdex, will have a Comdex Ranking of approximately 90 or above.

Disability Insurance Explained

‘Tis the season for doctors to be inquiring about personal long term disability insurance.

It is during this time of year when many doctors are wrapping up the final months of their training and preparing for the transition over into their first position.

This is such a popular period that we are going to share the top 5 things to know before getting disability insurance quotes or enrolling in a long-term disability insurance plan.

Table of Contents

How to Buy Long-Term Disability Insurance

1) Find an advisor who can coach you how to evaluate options. This should be an advisor who does not work for an insurance company.

And does not get most their compensation from any particular insurance company. You can find this out by simply asking what percentage of their income comes from the company they are recommending.

2) Review long term disability insurance quotes from all of the own occupation policies that exist.

Comparing multiple disability insurance quotes helps ensure you’re getting the best combination of coverage and cost.

As of the writing of this article, that would be Ameritas, Guardian, MassMutual, Principal, and Standard. You may be wondering why Northwestern Mutual was not listed.

That’s because their policy specifically requires that a doctor has to NOT be working in order to collect full disability benefits. While the other six I’ve mentioned all do have the true own occupation definition of disability.

Further Info

3) Make sure the disability insurance quotes you are reviewing are an apples to apples comparison.

They build each policy with its core benefits and it can have additional features called riders.

One of the ways we find that doctors are misled is that policy designs are not compared on an even playing field.

4) Before signing up, investigate the nuances of the contracts to find any limitations that are not highlighted.

For example, some plans have hoops you have to jump through in order to maintain the policy. Therefore, if you don’t keep up with them, the policy can change for the worse.

5) Take advantage of the privilege of your status because while you are in training you have two unique advantages.

1) You can get discounted rates that are guaranteed for the life of the policy and 2) you can use the starting practice limits to access a higher level of protection in some cases than what you would otherwise be able to get after joining your first practice.

The reason why this occurs is because the employer’s group long term disability insurance package prevents you from getting a higher level of protection, but if you use the starting practice limits you can ignore this offset

Conclusions

In addition to those five guidelines, it’s most important to get the process started before you see anyone for your health. The key is to get It while you are the youngest and healthiest you can be in order to lock in the lowest rates and get the most comprehensive coverage. In our experience almost half of doctors do not get the best offering because of a health issue popped up. In light of this don’t delay – get disability insurance quotes and secure a policy with no restrictions.

4 Questions Every Physician Should Ask About their Disability Insurance

Long-term, own-occupation disability insurance offers physicians critical income protection in the event of a serious illness or injury. However, not all disability insurance policies are equal.

The cost, terms, and benefits of disability insurance vary widely. And insufficient coverage can have disastrous financial consequences for physicians.

Whether you’re looking to purchase a new policy or evaluating your current plan, these four questions can help you assess the quality of disability insurance coverage:

1. Does My Policy Offer True Own-occupation Coverage?

Own-occupation disability insurance is the only type of coverage that offers physicians the necessary financial protection in the event of a disability. True-own occupation coverage will pay doctors benefits. In the event that any illness or injury prevents them from performing any key functions of their own specialty. The definitive feature of true own-occupation coverage is that it pays benefits if you cannot work in your own specialty. Even if you can perform other jobs in the medical field.

In many cases, inferior insurance policies will use “own-occupation” language. Without offering true own-occupation coverage. Oftentimes, group disability plans stipulate that they will pay benefits “in the event that you cannot perform each and every material duty of your own-occupation.”

Despite the use of the phrase “own-occupation,” this definition is actually highly restrictive. It essentially states you will only receive benefits if you are unable to perform every single function of your regular occupation. Under this definition, if you cannot work as an interventional neurologist. However, you could still perform other duties such as office consultations, you would not qualify for benefits.

True Own-Occupation

Now let’s consider the same situation with true own-occupation coverage. If your specialty is interventional neurology but a disability limits you to office consultations, in most cases but not all, if your interventional duties was the primary driver of your income, your policy would pay you full benefits. Every scenario is unique so it is recommended to speak with a claims specialist to determine how the claim would be paid.

Physicians invest tremendous amounts of time and money to earn income within their specialties. Imagine losing your current income. Then being denied disability benefits because you could still work as a teaching physician or even at a minimum-wage job.

Sadly, this scenario happens all too often under group disability coverage. Thoroughly review the fine print of your insurance policy to ensure you have the necessary financial protection in the event of a total or partial disability.

2. How Long Can I Afford To Live Without Income?

When you weigh your options and reviewing disability insurance quotes, consider how long you would stay afloat financially without any income. Every long-term disability insurance policy has an elimination period. The elimination period is the duration of time that must elapse after a claim is made. And before the policyholder begins receiving benefits. Most elimination periods range between one month and one year.

Shorter elimination periods offer more immediate financial support in the event of a disability. However, your premium rates will increase as you shrink your elimination period. By contrast, if you can afford to wait through a longer elimination period before receiving disability benefits, you can reduce the cost of premiums.

Thus, your ideal elimination period should reflect the maximum period of time you can afford to meet your financial obligations without a salary. If your elimination period is too short, you’ll pay higher premiums than necessary. Too long, and you’ll risk running out of money for essential expenses before you begin receiving benefits.

Carefully consider how emergency savings, financial support from family, or short-term disability coverage could help you cover critical bills. As well as expenses during your elimination period. As time goes on and you increase your personal savings, you can increase your policy’s elimination period to lower your premium costs.

3. What Compensation Does My Disability Insurance Cover?

Long-term disability insurance is designed to supplement lost income caused by serious illness or injury. However, a physician’s income typically includes both a base salary and a significant productivity bonus package. And many group disability plans will only pay benefits based on your salaried income. As a result, if you rely on a bonus to cover the cost of living expenses, many group plans will not pay enough benefits to meet your needs.

To ensure that your coverage offers sufficient financial protection to supplement all your earnings in the event of a disability, consult with a financial advisor who can help interpret your disability insurance quotes and benefits accurately.

4. How Will Other Forms Of Income Affect My Benefits?

When reviewing disability insurance quotes, pay close attention to how other forms of income will impact your benefits. As discussed above, many group policies will not pay out benefits if you are able to earn income by working any other job. Even a job outside your specialty or the medical field.

Similarly, many employer-sponsored plans will reduce your benefits if your disability qualifies you for financial assistance from Social Security disability insurance or workers compensation. In some cases your monthly benefit may be reduced dollar-for-dollar as a result of other income received.

With individual own-occupation disability insurance, your benefit amount will not reduce if you receive other forms of income or compensation.

If you’re interested in getting long-term disability insurance quotes for doctors or evaluating your current coverage, schedule a chat with one of our physician-specific financial advisors.

Request your own-occupation disability insurance quotes now!