Protect Your Money

Services • Insurance • Life Insurance • Term

Get Your Free Life Insurance Quote

40% of adults wish they had purchased life insurance at a younger age. Don’t wait to get reliable life insurance coverage that provides financial security for your family.

Protect Your Loved Ones

Get Life Insurance Coverage Today

See All Your Options

Our experts present all the options so the freedom to choose the best policy for you is always at your discretion.

The Best Rates

Your life insurance specialists will work with you to find the most affordable coverage available that includes all the necessary features you need.

Reliable Coverage

Our experts only work with the top life insurance companies on the market, so you can count on your policy being there in case the unexpected occurs.

Why buy term life insurance?

Term life insurance offers easy-to-understand protection for your loved ones. With term life, the policy’s owner pays a premium throughout the entire life of the policy. In return, the insurance company will provide a payment if the insured individual dies while the policy is still active.

Physicians who buy life insurance do so to replace the income that would be lost if they unexpectedly passed away. This coverage can help survivors pay bills, repay debt and cover funeral expenses.

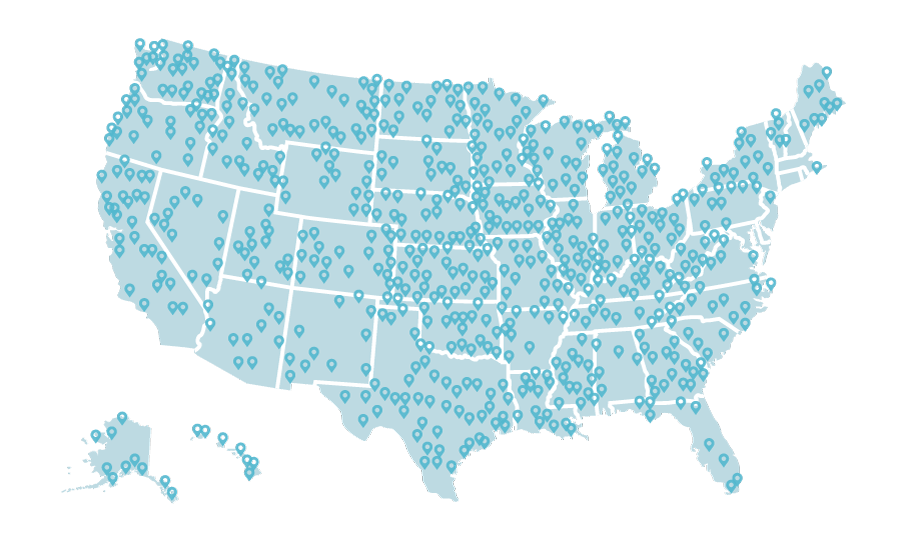

7,000+ satisfied physicians

Get Ongoing Service.

For no extra cost to you, our advisors advocate for you for the life of your insurance policy. In the case you need to put your policy to use or have questions about your coverage at any time, we are here for you.

We’ve Placed Billions of Dollars in Life Insurance Coverage.

Our team has worked with thousands of physicians to find their option for life insurance.

$3.3 Billion

and counting…

Get Free Life Insurance Quotes

When you receive your quote comparison, our experienced advisor will review the quotes, explain all your options and the verbiage in each policy in detail to help you create a customized plan that meets your needs and your budget. We will review each element of the plan and the cost associated with it to help you evaluate the value and build unique, cost-effective coverage tailored to your situation.