The best time to buy a house is never set in stone. The housing market is highly variable, and the best time to buy a house in 2010 can be very different from 2024.

However, there are certain markers that you need to look at to determine the best time to buy a house based on your own point of view and individual circumstances.

This guide will show you how you can do that with the help of stats, facts, and numbers.

Key Takeaways

- Timing a home purchase depends on personal finances and market conditions.

- State, profession, and loan costs impact home-buying decisions significantly.

- Homeownership can build equity, provide tax benefits, and contribute to long-term wealth.

- Early fall often offers lower prices and more inventory for buyers.

Table of Contents

When Should You Buy a House?

The short answer is that you should buy it as soon as possible, as long as you won’t fall into severe debt while doing so. The long answer is that it depends on many other factors.

For starters, the time when you should buy a house depends on your job, how much it makes, and how much you spend.

There’s also the time of the year to consider, as prices vary depending on when you need a home. Additionally, we have to consider mandatory expenses (like loans if you’re a physician) that you have to pay to avoid legal trouble.

In other words, the answer needs to be broken down much further for home buyers to get a clearer answer.

Related: Can Physicians Have Cool Cars and Houses and Still Retire Early?

What to Consider Before Buying a House

To buy a house in the U.S., you should keep these factors in mind.

1. The State You’re Located In

Where you live or plan to move to in the United States will significantly affect your decision. While the average house cost should be your primary concern, the median down payment and mortgage should also be considered.

The average home price in the United States is $412,300, but this number can fluctuate depending on where you are and the market value.

Also, a higher house price doesn’t necessarily mean a higher down payment and/or mortgage rates. For more reference, check the table below (all data is updated as of 2024):

| State | Median Down Payment | Average Down Payment Percentage | Cost | Average Mortgage Rate (%) |

| West Virginia | $6,853 | 9.60% | $168,166 | 6.85% |

| Mississippi | $6,064 | 9.60% | $181,695 | 6.58% |

| Louisiana | $6,729 | 9.20% | $204,977 | 6.72% |

| Arkansas | $11,603 | 11.90% | $209,299 | 6.72% |

| Oklahoma | $13,478 | 11.50% | $210,097 | 6.70% |

| Kentucky | $15,337 | 12.20% | $210,862 | 6.62% |

| Alabama | $7,198 | 10.10% | $228,283 | 6.68% |

| Iowa | $27,395 | 15.50% | $226,811 | 6.71% |

| Kansas | $15,353 | 11.90% | $232,507 | 6.84% |

| Ohio | $14,588 | 11.60% | $235,560 | 6.66% |

| Indiana | $16,430 | 12.20% | $245,505 | 6.75% |

| Michigan | $20,637 | 13.40% | $249,917 | 6.72% |

| Missouri | $15,260 | 12.20% | $252,431 | 6.76% |

| Nebraska | $21,375 | 14.00% | $265,433 | 6.74% |

| North Dakota | $21,536 | 13.10% | $268,647 | 6.85% |

| Pennsylvania | $22,679 | 13.10% | $271,911 | 6.62% |

| Illinois | $27,963 | 14.00% | $274,301 | 6.74% |

| South Carolina | $21,092 | 14.20% | $301,813 | 6.68% |

| New Mexico | $19,624 | 13.20% | $306,434 | 6.73% |

| South Dakota | $34,166 | 15.20% | $308,851 | 6.84% |

| Texas | $20,188 | 12.10% | $309,897 | 6.60% |

| Wisconsin | $28,846 | 14.60% | $313,952 | 6.74% |

| Tennessee | $23,151 | 14.00% | $323,646 | 6.71% |

| Georgia | $15,266 | 11.50% | $335,925 | 6.65% |

| North Carolina | $27,667 | 13.90% | $336,379 | 6.67% |

| Minnesota | $37,685 | 15.50% | $346,713 | 6.70% |

| Wyoming | $26,900 | 15.40% | $348,066 | 6.84% |

| Delaware | $36,052 | 15.60% | $390,830 | 6.70% |

| Virginia | $29,088 | 13.00% | $400,435 | 6.70% |

| Vermont | $43,600 | 17.40% | $404,238 | 6.82% |

| Maine | $28,850 | 13.10% | $405,684 | 6.80% |

| Florida | $33,411 | 15.20% | $418,097 | 6.60% |

| Maryland | $25,368 | 11.90% | $433,466 | 6.73% |

| Connecticut | $43,033 | 15.80% | $436,268 | 6.73% |

| New York | $49,150 | 16.60% | $452,823 | 6.58% |

| Nevada | $32,295 | 14.30% | $457,395 | 6.77% |

| Idaho | $61,067 | 19.90% | $461,661 | 6.76% |

| Montana | $72,290 | 20.40% | $473,023 | 6.81% |

| Rhode Island | $47,467 | 16.10% | $478,722 | 6.72% |

| New Hampshire | $61,449 | 18.30% | $505,012 | 6.84% |

| Oregon | $52,250 | 16.90% | $511,513 | 6.75% |

| Utah | $39,782 | 15.50% | $532,928 | 6.76% |

| New Jersey | $64,671 | 17.50% | $550,459 | 6.78% |

| Colorado | $66,062 | 17.20% | $563,964 | 6.66% |

| Washington | $69,389 | 17.00% | $614,411 | 6.81% |

| Massachusetts | $86,592 | 19.00% | $653,648 | 6.69% |

| District of Columbia | $100,800 | 20.40% | $724,949 | 6.83% |

| California | $85,179 | 18.20% | $806,674 | 6.68% |

| Hawaii | $44,440 | 13.10% | $986,887 | 6.70% |

As you can see, there are states like Oregon, Colorado, and Massachusetts where you need to think long and hard before you buy a house. On the other hand, the price of a house in West Virginia is far more affordable.

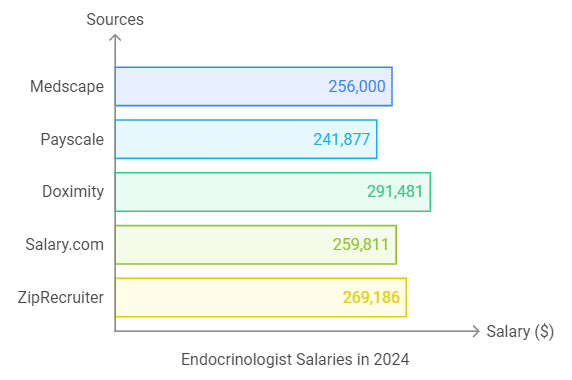

2. Your Current Profession

Not all professions can make it easier to buy a house. Additionally, some professions, like medicine, can drag you down because of the usual weight of their student loans.

This creates a question: should you first pay off your debt or put a house down payment? To answer this, you need to keep three financial considerations in mind:

Current Loan Interest Rate

If your existing loan has a high interest rate, paying it off may yield immediate savings. For example, if you have a loan at 10% interest and you owe $20,000, your annual interest cost is $2,000.

Paying this can free up cash flow that you can use for other investments, which can be a better choice than a down payment for a house.

Home Purchase Costs

We already talked about purchase costs, but we need to point out some additional considerations.

- Down payment: It’s often 15–20% of the home’s price. A home worth $350,000 will require a down payment of $70,000. If that’s not going to put you on a tight budget, buying a house could be a better option than immediately paying your loan/debt.

- Closing costs: They are usually worth 2–5% of the purchase price. In our example, this adds another $7,000 to $17,500.

- Mortgage interest rates: At a 7% mortgage interest rate (considering future inflation) for a 30-year mortgage of $280,000 (after the down payment), your monthly payment would be approximately $1,800.

As you can see, it’s a relatively hefty sum for a medium-priced house. If you can manage that while paying off your loan/debt, buying a house may be a good idea. Otherwise, paying the loan first to lift some burden would be a better choice.

Equity Building

When you buy a house, you immediately start building equity just with your down payment. As you pay off your mortgage, you also increase the equity over time.

For example, five years of paying your mortgage (while assuming a 4% annual appreciation in home value) will yield an equity growth of $114,828.

If you choose to pay off your loan first, you miss out on potential home appreciation if the home value increases by 4%. In other words, a home worth $350,000 could be worth about $426,000 after five years. That doesn’t consider variable factors like inflation.

In other words, regarding equity building, buying a house works in favor of paying your loans.

3. Tax Implications

Mortgage interest is often tax-deductible. This can significantly lower your effective interest rate. Say that you pay $20,000 in mortgage interest yearly and are in the 24% tax bracket. In that case, your tax savings would be $4,800.

If you choose to pay off your loans instead of buying a house, you won’t make use of tax benefits like mortgage interest deductions.

Related: The Real Estate Professional Tax Status Explained – A Guide for Doctors

4. Long-term Wealth Building

Owning a home can be an asset and a significant part of your net worth. Over time, as you pay down the mortgage and the property appreciates, your wealth can increase substantially.

Let’s go back to our $350,000 home value example. With an initial value of $350,000 and 30 years of mortgage (including interest), the total payment would be around $600,000.

Assuming a 4% appreciation, the estimated home value after 30 years would be nearly $1.26 million. In other words, the potential equity built here is approximately $660,000.

So, paying off loans can indeed improve cash flow now, but it can limit liquidity if funds are tied up in home equity.

To conclude this section, we can say that a house’s downpayment instead of immediately paying your loans is usually a better investment in the long run. However, paying a monthly mortgage combined with your loans and total expenses can take a massive toll for years to come.

So, it’s a matter of how much you can spare and for how many years you can handle such monthly payments.

When Is the Best Time of Year to Buy a House?

The best time of year to buy a house is typically in early fall (give or take one month, according to the condition of the local real estate market). Here’s why:

Less Competition

In this period, families are settling into their routines for the school year. There are generally fewer buyers in the market, which can lead to better negotiation opportunities.

Lower Home Prices

With less demand for houses in this particular period, prices tend to drop. Even if you don’t find a significant drop in the prices, you can still find better deals.

Increased Inventory

Putting the prices aside, the reduced number of house purchases in early fall gives you a broader selection to choose from because of the increased inventory.

Note: The timing can vary depending on so many factors. Consulting a real estate agent dramatically helps. Real estate agents can even get you good deals during the peak real estate season in early summer.

FAQs

At Which Stage of My Career Should I Buy a House?

The best career stage is when you already have a stable job(s) that covers your expenses, you are able to pay off any debt you have reliably, and you are able to save money consistently every month. It’s recommended to have at least six months of emergency savings as well.

When Should I Prioritize Paying off My Debt/Loan?

If you can quickly pay off your loan or debt within a few months, it can save you a lot of money as you pay off your mortgage later on. Plus, you won’t lose much equity in the long term since you’d be delaying your down payment for only a few months.

Should I Buy a House or Stay in a Rental Apartment?

Unless you’re constantly relocating, buying a house is almost always a better option. Rental monthly payments are getting so expensive that they’re comparable to mortgage payments now. So, if you’re taking a good chunk of your money every month, it’s better off investing in a long-term asset like a house.

Final Words

Buying a house is a difficult step for everyone, but it can be a lot more difficult for physicians because of their high student loans.

Sure, many medical specialties can pay a lot in the long term, but student loans and low payments during residency can put physicians at a massive disadvantage in their early lives.

It’s harder than ever to succeed in medicine on your own. You need a reliable partner in your field who can help you make the proper financial decisions from the get-go.

That’s Physicians Thrive, a team of physicians that was founded for the sole purpose of helping new physicians grow. Our extensive library contains every bit of information you need to thrive as a physician, and our team is ready to help every step of the way.

Contact us to get started, and let us help you thrive.