Your life can take unexpected turns, especially in a high-risk, high-reward profession like medicine.

When you’re “used” to a certain high income, you may seriously struggle if you suddenly can no longer work because of a disability.

That’s why Social Security disability insurance can be a good backup plan to support you with some money when you’re unable to work due to a qualifying disability.

In this guide, we’ll explain how this federal program works and how different it is from regular private disability insurance.

Key Takeaways

- SSDI is a federal program offering income if you’re disabled and can’t work.

- SSDI requires work credits; private insurance is based on policyholder coverage.

- SSA uses a stricter disability definition than private disability insurance plans.

- SSDI is tax-funded and portable; private plans require premiums and vary more.

Table of Contents

What Is Social Security Disability Insurance SSDI?

Social security disability insurance is a federal insurance program administered by the Social Security Administration (SSA). It provides income support to individuals who can’t work due to a qualifying disability.

Since SSDI is funded through payroll taxes, recipients must have worked and contributed to social security for a specific period.

The eligibility depends on accumulating work credits. This means working in a job where social security taxes are deducted from your paycheck, earning you credits. The concept also applies if you are self-employed as long as you’re paying self-employment taxes.

How many work credits you’ll need depends on your age when you become disabled. Younger workers often need fewer credits than older workers.

What’s the Difference Between SSDI and Private Disability Insurance?

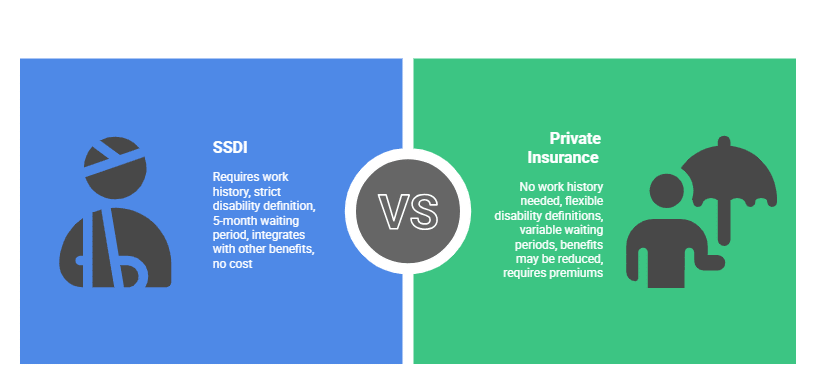

Both SSDI and private disability insurance provide financial support if you become disabled and can no longer work. However, they operate under different systems.

You may have already deduced that SSDI needs a work history, and private disability insurance doesn’t, so we’ll set that aside.

The Definition of Disability

A major difference we have is the strict definition of disability. The SSA definition is very strict, meaning you must have a medical condition that prevents you from doing any substantial gain activity (SGA) for at least 12 months or that is expected to result in death.

On the other hand, private disability insurance policies have different definitions of disability, such as own occupation (inability to perform the duties of your regular job) or any occupation (inability to perform the duties of any reasonable occupation).

The Waiting Period

The waiting or “ elimination” period refers to the time between when your disability begins and when you start receiving benefit payments.

Short-term private disability insurance typically has brief elimination periods of just weeks, while long-term policies may require waiting periods of up to a year before benefits begin.

On the other hand, SSDI has a fixed 5-month waiting period after the onset of your disability before benefits can begin.

Integration With Other Benefits

Private disability insurance benefits are generally paid in addition to any benefits you receive, including SSDI. Many private policies are designed to coordinate with SSDI benefits, ensuring you receive your full private insurance benefit amount regardless of SSDI payments.

However, the same doesn’t apply to SSDI benefits, which may be reduced if you receive workers’ compensation or other public disability benefits.

Unlike most private disability policies, SSDI may provide additional benefits for your spouse and dependent children in certain circumstances.

Cost and Portability

Since SSDI is already paid through social security taxes, you don’t have to pay any other premiums from your own pocket. Plus, it’s generally portable nationwide.

On the other hand, as a private disability insurance policyholder, you must pay your premiums regularly to ensure coverage, and the portability depends on the policy terms.

Here’s everything combined in a table:

| Feature | Social Security Disability Insurance (SSDI) | Regular (Private) Disability Insurance |

|---|---|---|

| Administered By | Social Security Administration (SSA) | Private Insurance Companies |

| Funding Source | Payroll taxes | Premiums paid by policyholder |

| Eligibility Basis | Work history and Social Security credits | Policy terms and definition of disability |

| Definition of Disability | Strict: Unable to do any substantial gainful activity (SGA) | Varies by policy (e.g., own occupation, any occupation) |

| Waiting Period | 5 months | Elimination period chosen by policyholder (e.g., 30, 60, 90 days) |

| Benefit Integration | May be reduced by other public benefits | Generally not reduced by SSDI (though policies may integrate) |

| Dependent Benefits | Possible for spouse and children | Typically none |

| Cost | No direct premium (funded by payroll taxes) | Premiums paid by the policyholder |

| Portability | Generally portable nationwide | Depends on the policy terms |

FAQs

What’s the Difference Between SSDI and Supplemental Security Income (SSI)?

SSDI requires a work history and Social Security credits, while SSI is a needs-based program for those with limited income and resources, regardless of work history.

Is SSDI the Same as Group Insurance?

No, SSDI is a federal program funded by payroll taxes. Group insurance is a type of private insurance offered through an employer or organization, with premiums paid by members or the employer.

Do You Get SSDI for Life?

SSDI benefits can continue as long as your disability prevents substantial gainful activity. The SSA may periodically review your case to determine continued eligibility.

Get the Best Disability Insurance Today

The term “disability insurance” is a wide umbrella that involves private disability insurance, social security disability insurance, and group disability insurance. They all have the same concept of providing benefits when you can’t work, but the way they work differs significantly.

You can quickly browse what each of them means and how they work. However, the truth remains that unless you’re well aware of what you’re doing, you’re likely to choose a policy that may not be the best fit for your situation.

Don’t risk your financial security. Contact Physicians Thrive, where our expertise bridges medicine and finance. We’ll assess your situation and guide you to the best possible disability insurance accordingly.