Key Takeaways

- Short-term disability (STD) insurance covers physicians’ temporary income loss from injury or illness.

- Typical STD policies pay 60–70% of income, with benefits lasting about 3–6 months.

- Qualification requires meeting employment, medical documentation, and insurer-specific criteria.

- Premiums depend on individual factors; taxation varies based on premium payment methods.

A temporary illness or injury can put your profession on hold, which can be detrimental for physicians who are already burdened by the costs of continuing education and loans.

Short-term disability insurance can be a lifesaver in such a situation, providing you with up to 70% of your income for the duration.

This guide will walk you through everything you need to know about short-term disability insurance to protect your finances in 2025.

Table of Contents

What Is Short-Term Disability Insurance (STD)?

Short-term disability insurance is a policy that provides financial protection when you can’t work due to a temporary illness or injury.

This coverage replaces a portion of your income (typically between 60–70% of your pre-disability earnings) as you recover.

STD is different from workers’ compensation, which only covers work-related incidents.

Conversely, STD covers disabilities regardless of where they occur, effectively making it a plan B when your primary income suddenly pauses because of a temporary condition.

Here are the key components of STD:

- The benefit period : this is how long you receive your payments. It averages between 3–6 months, though some policies can extend the benefits to 12 months.

- Elimination period : this is the waiting time between the moment that the disability occurs and the moment when you start receiving your benefits. It often lasts between 7–14 days.

- The Benefit amount: this is the percentage of your monthly income that your policy will pay out.

- Definition of disability : how individual insurance companies define the inability to work.

Most short-term disability policies cover common scenarios, like recovery from surgery, severe illness, or injuries.

The process typically goes like this:

- You file a claim with your insurance provider.

- You provide medical documentation of your condition.

- You wait for the elimination period.

- You start to receive benefits if approved.

As for the cost, it varies based on your occupation, age, health, status, and benefit amount.

Premiums generally range between 1% and 3% of your annual income.

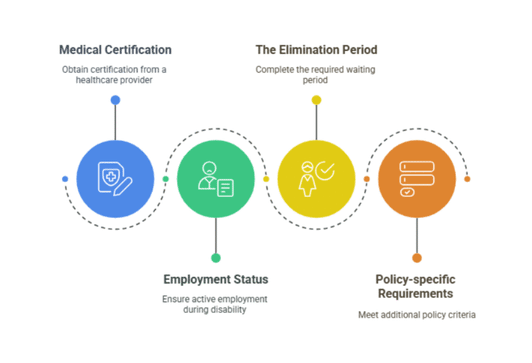

How to Qualify for Short-Term Disability Insurance

To qualify for STD, you must meet specific criteria established by your insurance company.

They are as follows:

1. Medical Certification

Your disability must be certified by a licensed healthcare provider. This certification must include:

- A diagnosis of your condition.

- Expected duration of your disability.

- A treatment plan.

- Limitations that prevent you from working.

This is the baseline of requirements, but individual insurance companies may require additional medical examinations or documentation before approving your claim.

2. Employment Status

Most STD disability policies have work requirements. They are as follows:

- You must be actively employed when the disability begins.

- Many policies require you to work a minimum number of hours weekly.

- Some plans include a waiting period for new employees.

Note: Your best approach is always to check your policy details to clarify specific employment requirements.

This will also clear out any exclusions and limitations that may affect benefits payable.

3. The Elimination Period

You must complete the elimination period (7–14 days) before you can start receiving benefits.

Note that some policies have different elimination periods for illnesses versus injuries, with illness-related claims often having longer waiting periods.

4. Policy-specific Requirements

Everything we’ve covered so far includes the general requirements to qualify for STD.

However, individual insurance providers may have additional qualifying criteria, including but not limited to the following:

- The premium payments must be current (which means that you have paid all your insurance premiums up to the present date).

- The disability must match your policy’s definition of disability.

- The condition must not be pre-existing.

Related: The 5 Best Disability Insurance Providers in 2025

What Qualifies for Short-term Disability Insurance?

Recovery from surgery, pregnancy/childbirth complications, and severe illnesses like cancer and stroke are among the most common claims of short-term disability insurance.

Injuries from accidents are also common.

Chronic conditions that have occasional flare-ups are also eligible for STD.

These conditions can lay low for a while but then suddenly prevent an individual from working effectively.

They include:

Mental health conditions like bipolar disorder and severe depression may qualify for STD as well.

However, they need proper documentation and written diagnostic sheets made by licensed therapists to prevent fraud.

Conditions That Don’t Qualify for STD

Here are the conditions that often don’t qualify:

- Pre-existing conditions: many policies exclude or limit coverage for conditions that you had before purchasing the policy. The exclusion period varies, but you’re looking at an average of 3–12 months.

- Self-inflicted injuries: disabilities resulting from intentionally harming yourself or attempting suicide don’t qualify.

- Criminal activity: any injury or illness that occurs while committing a crime isn’t covered under STD.

- Substance abuse : disabilities that result directly from alcohol or drug abuse usually don’t qualify. However, some policies do cover the treatment programs.

- Short-term illnesses: regular illnesses like common colds and minor infections often resolve within the elimination period and don’t qualify.

- Normal pregnancy: while complicated pregnancy or childbirth are covered under STD, normal pregnancy and recovery aren’t typically covered.

Is Short-Term Disability Insurance Taxable?

The taxation of STD benefits depends on how the premiums are paid. Let’s break it down:

Employer-paid Premiums

If your employer pays the entire premium for your STD coverage, the benefits you receive will be fully taxable as ordinary income.

Your employer will report these payments on your W-2, and you’ll need to include these benefits when filing your annual tax return.

Employee-Paid Premiums with Pre-tax Dollars

If you pay premiums through a payroll deduction using pre-tax dollars, your benefits will be taxable.

This is highly common in cafeteria plans (where you get to choose between taxable and non-taxable benefits) or flexible benefit arrangements.

Employee-Paid Premiums with After-tax Dollars

If you pay your premiums yourself with after-tax dollars, your benefits will be tax-free.

This applies to individual disability insurance policies that you purchase directly.

It also applies if you opt to have premiums deducted from your paycheck after taxes.

Note: If both you and your employer share premium costs, their portion will be taxable, and your (after-tax) premium is tax-free.

You have to keep records of how your premiums were paid to accurately report your disability income on your tax returns.

Is Short-Term Disability Insurance Mandatory?

The short answer is no.

STD isn’t federally mandated in most states, but there are five states and a territory where STD is currently mandatory:

- California

- Hawaii

- New Jersey

- New York

- Rhode Island

- Puerto Rico

In these locations, employers must provide short-term disability coverage through state programs, private insurance, or approved self-insurance plans.

Still, even if it’s not required by law in most other states, STD is valuable and can provide much-needed protection against unexpected income loss due to a disability.

What’s the Difference Between STD and LTD?

Here’s how both forms of disability insurance differ:

Duration of Benefits

Short-term disability benefits typically last for a limited time frame, usually between 3–6 months and up to 12 months.

This coverage is designed for temporary conditions from which you’re likely to recover.

Long-term disability benefits, on the other hand, can continue for several years or until retirement age in serious cases.

LTD policies commonly provide benefits for two, five, or 10 years or until age 65.

Elimination Period

As mentioned earlier, the STD elimination period is a relatively brief period of 7–14 days.

After all, the point of it is to provide quick benefits to bridge the gap between sudden loss of income and transitioning back to work.

It wouldn’t make sense for its elimination period to be too long.

On the other hand, LTD has a much longer elimination period that starts at 90 days and up to 365 days.

A longer wait means paying considerably less premiums, but you’ll have to rely on your savings after the disability and until you receive benefits.

Benefit Amount

STD policies generally replace a higher percentage of your income, providing 60–70% of your disability earnings.

Additionally, some employer-sponsored plans may offer more generous replacement rates.

LTD insurance often replaces 50–60% of your income.

This is to account for the extended period the insurance company might pay benefits.

However, in some cases of complete disabilities, it’s not uncommon to see benefits reaching up to 100%.

Cost Differences

Because of its shorter timeframe, STD policies cost less than LTD.

Premiums average around 1–3% of your annual income, while LTD can go up to 4%.

Get the Best Insurance With Physicians Thrive

Disability insurance for physicians may not be a legal must, but this profession can be dangerous, and sudden injuries can happen at any time.

This is why disability insurance is highly recommended for such an occupation.

However, with so many policies, information, and numbers to take into account, it’s easy to purchase an insurance policy that doesn’t suit you, especially if you end up paying high premiums that you initially thought you could afford.

Get a quick shortcut to the disability insurance end-game with Physicians Thrive.

We’re a team of doctors who know how the whole game works, and we’ll provide you with a tailor-made plan that suits you the most.

Get in contact, and let us do the rest.