The Qualified Dividends and Capital Gains Worksheet is used by investment-savvy physicians to calculate gains on their investments when filing their taxes.

It’s included in the Internal Revenue Service’s Instructions for Form 1040 (and 1040-SR) and in many tax filing and preparation software services.

If you’re a physician who has opted to invest instead of paying off debt, you’ll likely need to use this worksheet at some point.

This article discusses its purpose and provides tips on how to use it properly.

Key Takeaways

- The Qualified Dividends and Capital Gains Worksheet is used to calculate taxable qualified dividends and capital gains.

- Qualified dividends have a lower tax rate than ordinary sources of income and have three tax brackets: 0%, 15%, and 20%.

- Capital gains fall into two categories: short-term and long-term.

- You’ll need to have all your tax forms ready at hand to use the worksheet.

Table of Contents

Why You Need the Qualified Dividend and Capital Gain Tax Worksheet

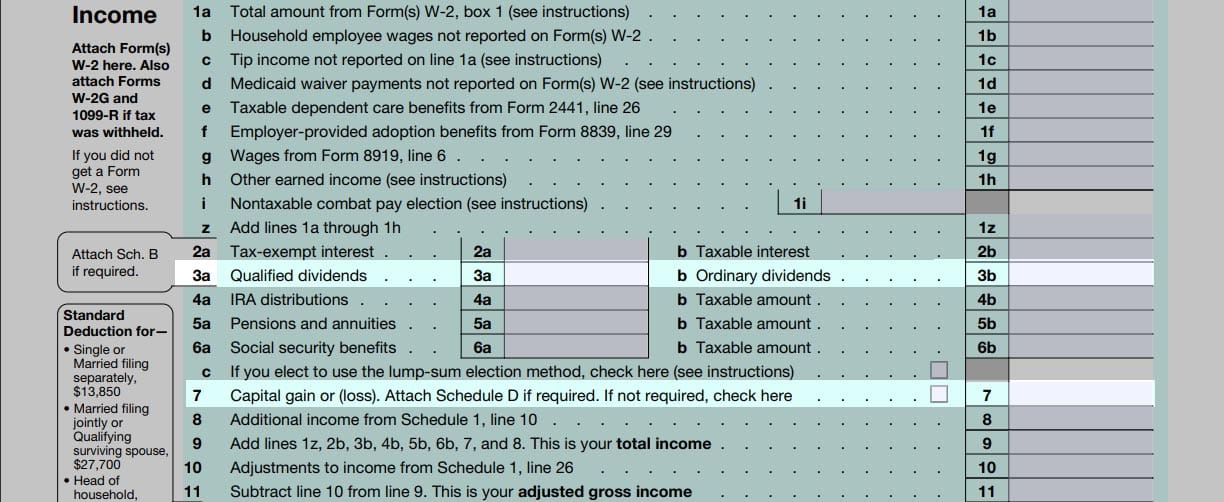

You’re meant to use this worksheet if you intend to report qualified dividends (at line 3a) or capital gains (at line 7) of IRS forms 1040 and 1040-SR, respectively.

See the highlighted portions in the image below for context:

However, it isn’t one of the documents you need to submit when filing your taxes.

Even though you’re not supposed to submit this form to the IRS, it’s still significant for your tax-filling process.

To understand why, we’ll first cover what qualified dividends and capital gains are.

Qualified Dividends

Dividends are a portion of a company’s earnings that are distributed to investors on a monthly, quarterly, semi-annual, or annual basis.

At Physicians Thrive, we recommend investing in dividend stocks, as one of our six passive income ideas for diversifying your income as a doctor.

Concerning taxes, not all dividends were created equal.

While the IRS taxes one set of dividends at the same rate as income tax (ordinary income), the other set of dividends gets taxed at a lower rate.

Dividends that fall into the latter category are called qualified dividends.

As the IRS puts it in Line 3a of the Form 1040 instructions, “Qualified dividends are eligible for a lower tax rate than other ordinary income.”

Another characteristic that distinguishes a qualified dividend from ordinary income is how long you’ve owned the shares of the company paying it.

You need to have owned them for at least 60 days from the ex-dividend date. The IRS defines the ex-dividend date as follows:

“The ex-dividend date is the first date following the declaration of a dividend on which the purchaser of a stock isn’t entitled to receive the next dividend payment.”

Qualified dividends have three tax brackets: 0%, 15%, and 20% (see lines 9, 18, and 21 of the worksheet). All three brackets correlate to the taxpayer’s income.

Using the worksheet will help you determine how much tax you have to pay on your dividends (depending on the tax bracket you belong to).

Capital Gains

If you’ve invested in real estate or other assets, you’re obligated to pay capital gains tax when you sell them for more than you bought them.

The IRS categorizes capital gains into short-term and long-term. In the former category, the asset you sold belonged to you for a year or less, whereas the latter type relates to assets held for more than 366 days.

It’s also possible to lose money after selling an asset (i.e., you sell it for less than you bought it) and both the IRS and Form 1040 take cognizance of this fact.

You’ll need to use Schedule D to total your short and long-term gains or losses. If you make a gain, you’ll enter it on line 7 of form 1040 (pictured above).

Again, the worksheet helps you determine the tax you’ll pay on your capital gains.

Tips for Using the Qualified Dividends and Capital Gains Worksheet

Here are a few tips you can apply when using the worksheet:

- Tip One – Gather Your Tax Forms: The worksheet references lines and checkboxes from forms 1040, Schedule D, and so on. If you don’t have these forms at hand when filling it, you may run into issues.

- Tip Two – Start With Form 1040 or 1040-SR First: You’ll need to include figures from this form into the various lines of the worksheet. For example, line 1 requires you to enter the tax calculated on line 15 of Form 1040 or 1040-SR (your taxable income).

- Tip Three – Follow the Instructions in the Worksheet: The worksheet will have you jumping from one line to the next (and one form to the next). Do the calculations using figures from the various lines in the worksheet, closely following the instructions.

By the time you get to line 25 of the worksheet, you should arrive at your final tax sum, which you’ll enter at line 16 of form 1040.

Final Thoughts

The Qualified Dividends and Capital Gains worksheet can be complicated, especially when you add Form 1040 to the mix.

Consider booking a consultation with one of our advisors on the best way to approach using this worksheet when filing your taxes.

You can contact us today to prevent errors when reporting on your qualified dividends and capital gains.