Practicing medicine isn’t just about saving lives—it’s also about earning fair compensation for your expertise.

Understanding compensation trends is crucial for physicians planning their careers, managing finances, or seeking job satisfaction.

So, how much do doctors make in 2024? The answer varies by specialty, region, and even gender.

Drawing from the 2024 Physician Compensation Report, we’ll provide a high-level overview of physician salaries and income figures.

We’ll cover the highest-paying specialties, regional variations, and the role of bonuses, along with key trends and insights to help you make informed career decisions.

Let’s dive in.

Key Takeaways

- Physician salaries vary widely by specialty, region, and persistent gender pay gaps.

- Oncology, preventive medicine see growth; emergency medicine and ophthalmology face declines.

- Bonuses, incentives, and rural roles significantly enhance total physician compensation.

- Burnout drives demand for flexible schedules despite rising physician salaries in 2024.

Table of Contents

Physician Salary Figures In 2024

| Role | Average Salary (2024) | % Change from 2023 |

|---|---|---|

| Primary Care Physicians | $265,000 | +1.9% |

| Specialists | $382,000 | +3.8% |

| Neurosurgeons | $788,000 | +2.5% |

| Pediatricians | $218,266 | +1.5% |

Average Salaries Across Roles

When it comes to physician compensation, roles and responsibilities play a significant factor.

In 2024, the average salary for primary care physicians (PCPs) is $265,000, a modest increase from $260,000 in 2023.

Specialists, on the other hand, earned an average of $382,000, up from $368,000 the previous year.

Surgeons consistently remain among the highest earners, with neurosurgeons, orthopedic surgeons, and thoracic surgeons leading the pack, earning well above $700,000 annually.

At the lower end, pediatricians and preventive medicine physicians report average salaries closer to $200,000.

Our Take

Physician salaries continue to rise, but how do they compare to other professions requiring extensive education and training?

For instance, while the average neurosurgeon earns $788,000 annually, executives in Fortune 500 companies or attorneys in major markets often earn comparable amounts with similar educational investments.

However, the responsibility for human lives and the emotional toll physicians face sets their compensation apart.

Over the past decade, physician salaries have generally kept pace with inflation, but economic pressures like rising living costs and reduced reimbursements in certain areas may be narrowing this margin.

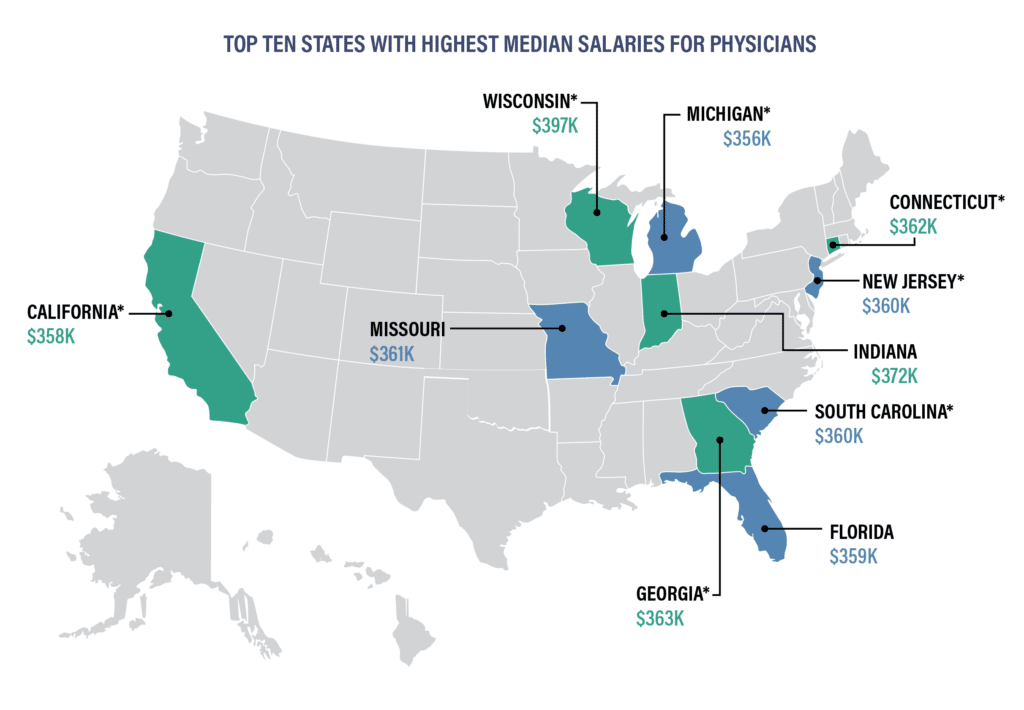

Regional Pay Variations

Where physicians practice has a massive impact on earnings.

Physicians in certain metro areas and states enjoy substantially higher salaries due to factors like physician shortages, patient demographics, and cost-of-living adjustments.

Top Paying Metro Areas:

- Charlotte, NC: $430,890

- St. Louis, MO: $426,370

- Oklahoma City, OK: $425,096

Lowest Paying Metro Areas:

- Washington, DC: $342,139

- Baltimore, MD: $346,260

- Boston, MA: $347,553

Physicians in rural areas often receive higher pay as well as attractive signing bonuses to offset challenges like fewer resources, greater workloads, and geographic isolation.

For example, some rural clinics reported median annual salaries exceeding $650,000 for high-demand specialties.

Our Take

The wide variation in physician pay across regions isn’t just about salary figures—it’s about lifestyle and healthcare accessibility.

Charlotte, NC, and Oklahoma City stand out with compensation exceeding $425,000, partly due to growing populations and a greater need for healthcare services.

By contrast, lower-paying regions like Washington, DC, and Baltimore, MD, often have higher concentrations of physicians, creating less competition for top salaries.

Rural areas continue to offer substantial pay premiums to offset challenges such as resource constraints, higher workloads, and geographic isolation.

Compensation by Specialty

| Specialty | Median Salary (2024) | % Change from 2023 |

|---|---|---|

| Neurosurgery | $788,000 | +2.5% |

| Thoracic Surgery | $760,000 | +1.8% |

| Oncology | $380,000 | +6.2% |

| Emergency Medicine | $330,000 | -6.0% |

Physicians’ salaries vary widely by specialty. Among the highest earners in 2024:

- Neurosurgery: $788,000

- Thoracic Surgery: $760,000

- Orthopedic Surgery: $748,000

Specialties experiencing notable salary growth include:

- Oncology: +6.2%

- Pediatric Infectious Disease: +4.9%

- Preventive Medicine: +4.0%

Meanwhile, some specialties saw salary declines:

- Ophthalmology: -7%

- Emergency Medicine: -6%

- Allergy & Immunology: -5%

These shifts often correlate with changes in patient demand, workforce shortages, and reimbursement structures.

Our Take

Specialty selection remains one of the most significant factors in physician earnings.

Neurosurgery and thoracic surgery lead the field with median salaries nearing $800,000. These high earnings reflect the extensive training and high stakes associated with these specialties.

Meanwhile, specialties like oncology are seeing rapid growth in compensation, with a 6.2% increase in 2024, driven by rising demand for cancer care.

On the other hand, emergency medicine and ophthalmology have seen declines due to shifts in patient volumes and reimbursement policies.

These trends highlight the importance of choosing a specialty that aligns with both passion and market demand.

Physician Salary Insights and Trends

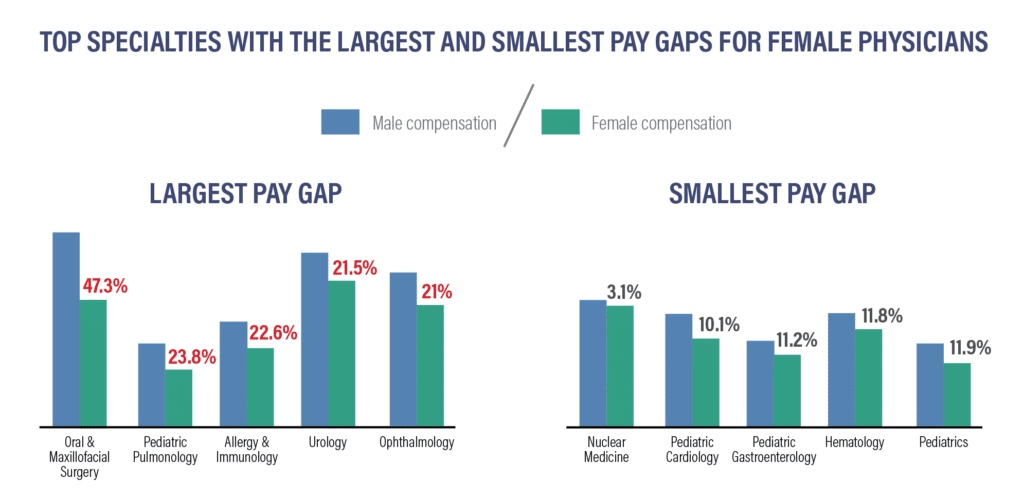

Gender Pay Gaps

| Specialty | Male Average Salary | Female Average Salary | % Pay Gap |

|---|---|---|---|

| Oral & Maxillofacial | $568,000 | $395,000 | 47.3% |

| Pediatric Pulmonology | $282,000 | $227,000 | 23.8% |

| Nuclear Medicine | $394,000 | $382,000 | 3.1% |

The gender wage gap continues to persist in 2024, though there are signs of slow progress.

Female primary care physicians earn 16% less than their male counterparts, an improvement from the 22% gap in 2020.

For specialists, the gap is wider, with men earning an average of $415,000 compared to $327,000 for women—a 21% disparity.

Some specialties, such as Oral & Maxillofacial Surgery and Pediatric Pulmonology, report wage gaps exceeding 20%, while fields like Nuclear Medicine show much smaller differences of around 3%.

Our Take

While gender pay disparities persist, 2024 marks some progress.

Female primary care physicians now earn 16% less than their male counterparts, an improvement from a 22% gap in 2020. Despite this, some specialties, like oral and maxillofacial surgery, report staggering gaps exceeding 47%.

On the flip side, nuclear medicine has nearly achieved pay equity, with only a 3% gap. Advocacy for transparency, negotiation training, and mentorship programs continue to play vital roles in narrowing these gaps.

Physicians are encouraged to benchmark their salaries against peers and negotiate assertively to secure equitable compensation.

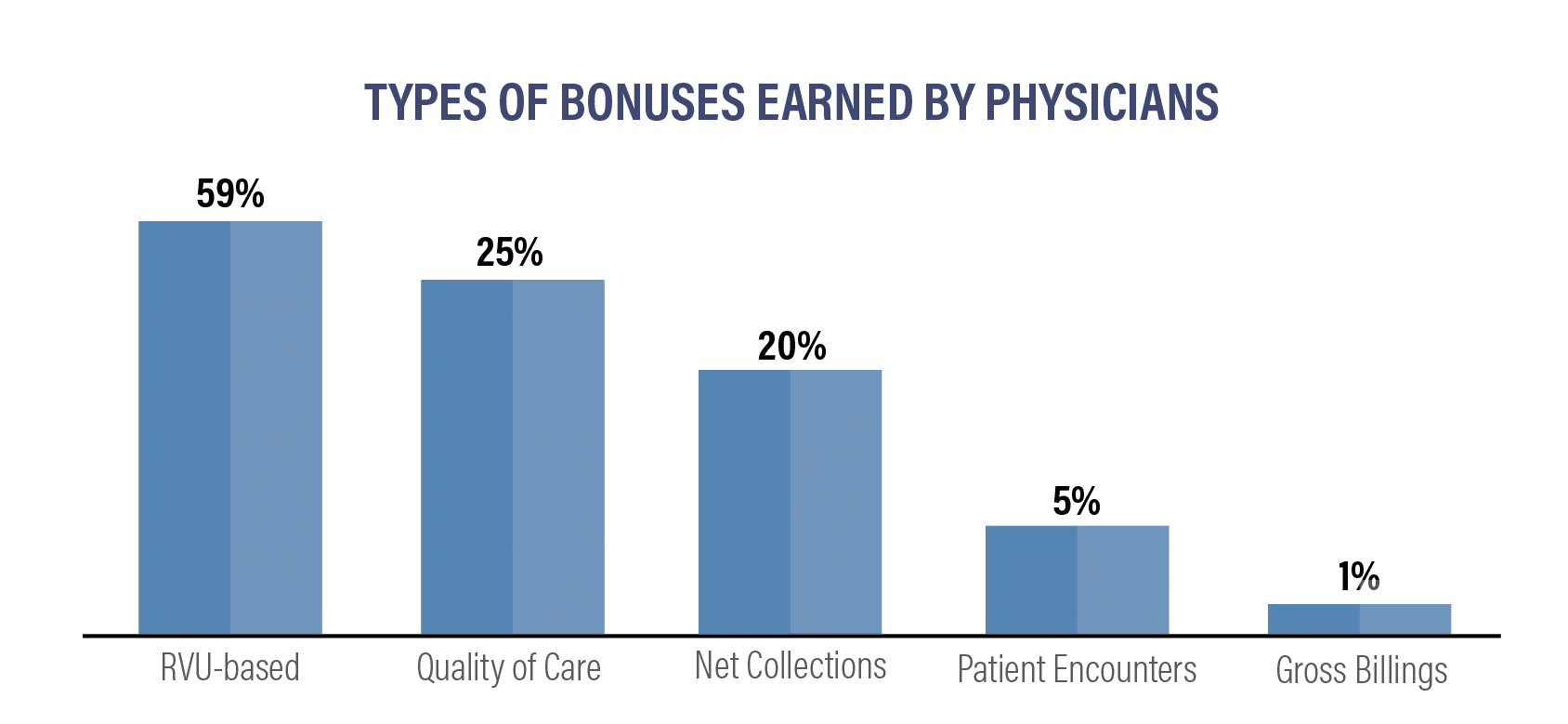

Bonuses and Incentives

Incentive structures remain a critical part of physician compensation.

RVU (relative value unit)-based bonuses are the most common and represented 59% of bonuses awarded in 2023.

The average signing bonus for new hires rose to $37,473, up 20% from the prior year.

Specialties with the highest incentive bonuses include:

- Orthopedic Surgery: $134,000

- Cardiology: $88,000

- Radiology: $80,000

While bonuses are a valuable addition to physician income, they often come with increased workloads, higher patient volume expectations, or performance benchmarks.

Our Take

Incentive structures like RVU-based bonuses, which accounted for 59% of bonuses in 2023, remain a cornerstone of physician compensation.

Specialties like orthopedic surgery and cardiology report the highest average bonuses, at $134,000 and $88,000, respectively. These bonuses, however, often come with increased patient volume expectations and performance metrics.

As telehealth and other care models grow, new types of bonuses, such as those tied to virtual visits, may emerge. Physicians should evaluate the terms of these bonuses carefully to ensure they align with their workload and career goals.

Year-Over-Year Trends

Despite steady growth in most areas, physician salaries across metro areas experienced a 2.4% decline on average, primarily due to inflation and reduced reimbursement rates.

However, regions like Oklahoma City (+6.3%) and Baltimore (+4.6%) bucked the trend with salary growth exceeding 4%.

Beyond the Salary: The Bigger Picture

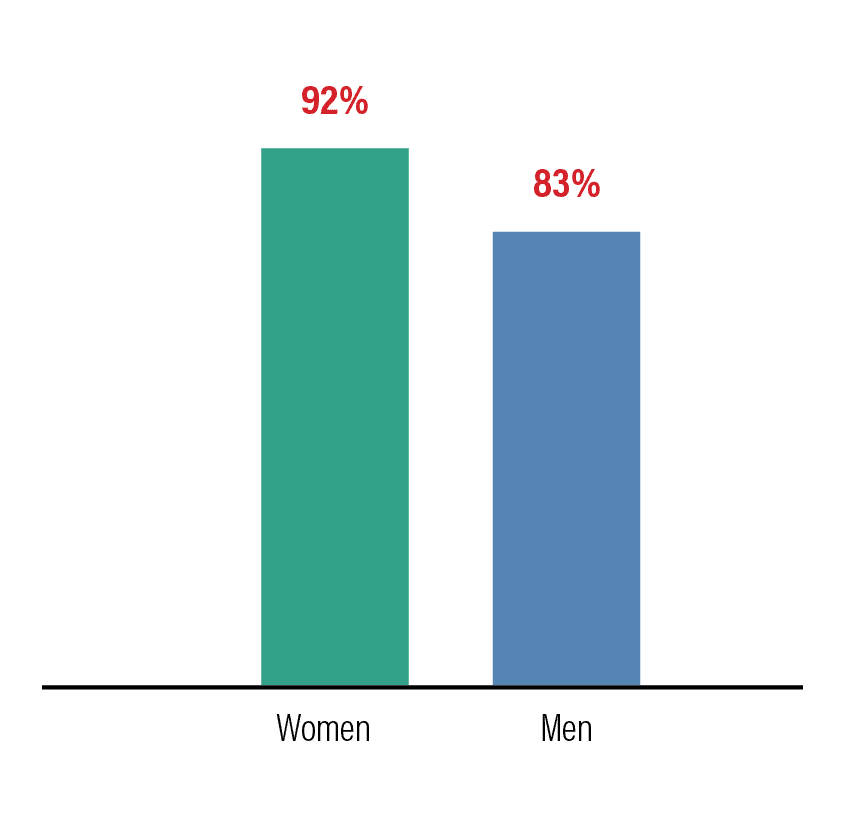

Work-Life Balance and Burnout

The rising compensation figures tell only part of the story. Physicians are working longer hours than ever, with most averaging over 50 hours per week.

Critical care physicians top the charts with nearly 60 hours per week, while dermatologists and allergists average closer to 44 hours.

Despite higher pay, more than 70% of women and 60% of men report feelings of overwork and burnout.

Burnout is most prevalent in:

- Emergency Medicine (65%)

- Pediatrics (59%)

- Internal Medicine (49%)

The workload-burnout dynamic is driving many physicians to prioritize work-life balance, with one-third reporting that they have negotiated lower salaries for fewer hours or flexible schedules.

Despite higher salaries, many physicians are prioritizing work-life balance over earnings.

Critical care physicians average nearly 60 hours per week, while dermatologists enjoy closer to 44 hours, reflecting significant disparities in workload. Burnout rates remain alarmingly high, with 65% of emergency medicine physicians reporting symptoms.

To combat this, many doctors are negotiating lower salaries in exchange for reduced hours or flexible schedules. Telemedicine has also opened the door to hybrid roles that allow for better balance between professional and personal life.

Hiring and Demand

Demand for physicians continues to outpace supply, especially in rural and underserved areas.

By 2034, the U.S. faces a potential shortage of up to 124,000 physicians, including 48,000 primary care doctors and 76,000 specialists.

Specialties in high demand include:

- Family Medicine

- Radiology

- Cardiology

- Psychiatry

Telehealth and urgent care models have shifted recruitment efforts, with hospitals and health systems focusing more on flexibility and hybrid roles to attract new talent.

With the U.S. projected to face a shortage of up to 124,000 physicians by 2034, demand for healthcare professionals is intensifying.

Family medicine, psychiatry, and radiology are among the most sought-after specialties. Rural and underserved areas continue to offer the highest salaries and bonuses to attract talent.

To address these shortages, many healthcare systems are turning to telemedicine and advanced practitioners like nurse practitioners and physician assistants.

Physicians exploring new roles should consider how these factors influence compensation and career trajectory.

Future Projections

With an aging population and increasing healthcare needs, compensation will likely continue to rise in high-demand specialties and underserved regions. However, economic pressures like Medicare reimbursement cuts and inflation may temper these increases.

As the population ages and healthcare needs grow, compensation for in-demand specialties is expected to rise further.

However, looming Medicare reimbursement cuts and inflation could temper these gains. Emerging technologies like AI and remote patient monitoring are reshaping how care is delivered, potentially influencing compensation models.

For physicians, staying informed about these shifts and adapting to new care delivery methods will be essential for career growth and financial stability.

Key Takeaways for Physicians

- Know Your Worth: Benchmark your salary against regional and specialty averages.

- Negotiate Strategically: Compensation is more than just base salary; evaluate bonuses, benefits, and work-life balance options.

- Plan Ahead: Use tools like the 2024 Physician Compensation Report to make informed decisions about your career and financial future.

- Seek Expert Advice: From contract reviews to financial planning, professional guidance can ensure you secure fair and competitive compensation.

Final Thoughts

Physician compensation is a multifaceted topic influenced by specialty, location, experience, and evolving industry trends.

While the numbers provide valuable insights, they also highlight broader issues like gender equity, burnout, and the need for proactive financial planning.

Whether you’re negotiating a contract, considering a move, or simply curious about your standing in the profession, the 2024 Physician Compensation Report offers a comprehensive resource to guide your decisions.

Download the full report today to explore detailed data, trends, and actionable takeaways for physicians at every stage of their careers.