The salary for physicians who own their medical practices in the United States ranges from $53,500 to $370,000, with a median of $272,959.

That massive range shows how difficult it is to provide an accurate answer to this question, as you have many factors that can affect your income.

In this guide, we’ll have a look at these factors and provide some actionable steps you can take to reduce your practice expenses and increase your average salary.

Key Takeaways

- Physician-owner salaries range widely, influenced by specialty, location, and operations.

- Payer mix, retention, billing, and efficiency directly affect private practice income.

- Reinvesting profits and adding services can significantly boost net annual earnings.

- Contract negotiation, tech upgrades, and referrals can increase revenue by 30% or more.

Table of Contents

What Are the Factors Affecting a Private Medical Practice Salary?

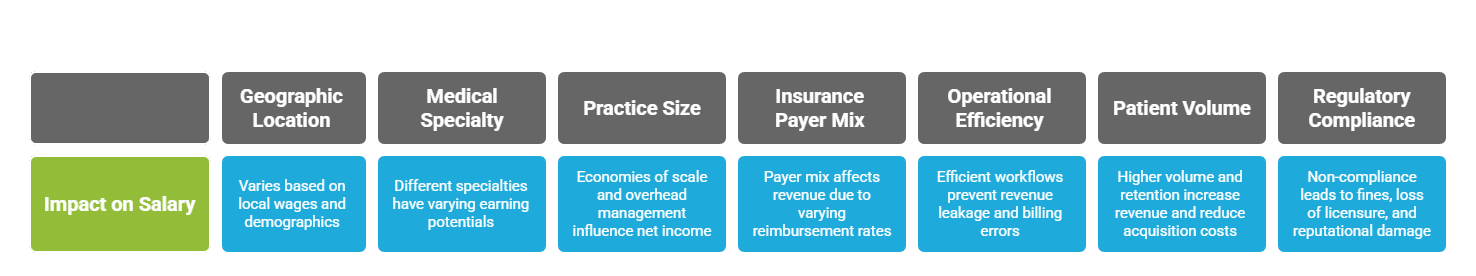

Here’s why it’s challenging to provide an accurate estimate or even a range of owning a medical practice salary.

1. Geographic Location and Local Demographics

Service prices vary by location, and given the vast geographic area of the United States, you’ll find significant salary differences between states.

For example, areas such as Phoenix, Boston, and New York offer higher average wages for family medicine physicians, with annual salaries ranging from around $214,000 to nearly $296,000 . ( Data by the U.S. Bureau of Labor Statistics).

High wages aren’t limited to major cities. Some rural areas with high demand and fewer providers, such as Northwest Colorado and Eastern Kentucky, offer competitive salaries exceeding $280,000 .

Why? Because of the scarcity of services and the higher location quotient.

Local demographics like the age distribution and socioeconomic status also affect the patient needs and payer mix, which further shapes revenue potential and salary levels.

2. Medical Specialty and Service Offerings

The type of medical service you provide is one of the biggest contributing factors to your earnings.

According to our data, pediatric physicians earned around $260,000 in 2024 , while plastic surgeons had a much higher earning potential of $536,000 in the same year.

Of course, these numbers don’t specify whether the earners have their own practices.

However, they show how different the earning potential can depend on the complexity and the type of service provided.

This also means that practices that expand their service offerings to include other services like diagnostic testing, minor surgeries, or wellness programs can boost their earnings much more.

3. Practice Size and Overhead Costs

The practice size affects the final net salary through economies of scale and overhead management.

For example, you might expect that larger practices cost a lot more to operate, and you’d be right.

However, these practices also benefit from shared administrative costs and resources, which can reduce individual overhead burdens and increase net income for physicians.

On the other hand, private practices typically consume about 50-60% of revenue, paying for staff salaries, malpractice insurance, medical supplies, and facility expenses.

Efficient management of such expenses can be the difference between losing money and making a decent profit.

You must minimize unnecessary expenses as much as you can. These include, but aren’t limited to:

- Excessive or unnecessary printing and paperwork

- Unused or underutilized software and subscriptions

- Inefficient communication systems

- Poor record keeping (which leads to lost documents and billing errors)

- Excessive postage and shipping costs

These factors combined add up to the costs, and they’re even more important to consider for solo practitioners since they face an even higher relative overhead.

4. Insurance Payer Mix and Reimbursement Rates

The composition of a practice’s payer mix is a critical determinant of revenue and salary, and yet, it’s often poorly anticipated by first-time practice owners.

The term ‘payer mix’ refers to the distribution of patients based on who pays for their healthcare services—commercial insurance, government programs like Medicare and Medicaid, or self-pay patients.

Ideally, your practice should have a balanced payer mix with no single-payer accounting for more than 50% of revenue to reduce financial risk.

Commercial insurance typically reimburses at higher rates than government programs like Medicare and Medicaid.

So, practices with a larger portion of privately insured patients tend to generate more income.

Self-pay patients can also impact revenue depending on collection efficiency.

Changes in reimbursement polices by major payers can significantly affect practice income and thus, the final salary.

Related Reading: Psychiatrist Pay: The Ultimate Guide to Understanding Insurance Reimbursement

5. Operational Efficiency and Billing Practices

Inefficient workflows, like manual appointment scheduling or disorganized billing, can lead to revenue leakage.

If your practice uses outdated billing software or lacks dedicated billing staff, it’ll be subject to delayed payments or undercoding errors.

This means you’re missing out on revenue that should rightfully be yours.

Some practices outsource to third-party billing services, but establishing your own in-house billing system can be more cost-effective long-term.

Moreover, investing in staff training and leveraging data analytics can help you identify bottlenecks and optimize billing operations.

Related reading: Locum Tenens Billing: What Practice Owners Must Know

6. Patient Volume and Retention

Patient volume is always important; more paying customers mean more revenue.

However, patient retention, despite being equally important, isn’t always given the same attention.

For one, retaining your existing patients is helpful for your practice’s reputation.

If your patients come to you and refuse to go to someone else, they’re likely to recommend you through word of mouth.

Additionally, keeping your patients increases their “lifetime value,” which reduces the need for costly new patient acquisition.

Consider this important fact: increasing your patient retention by just 5% can boost your profits anywhere from 25% to 95%.

The good news is that you don’t need special precautions for patient retention.

If your practice already focuses on quality care, good communication, compliance, and convenience, you’re automatically improving your patient retention chances.

7. Regulatory Compliance and Legal Risks

Speaking of compliance, your practice should follow all the healthcare laws and regulations in the industry.

While being compliant doesn’t have a direct impact on revenue, non-compliance can result in fines, criminal charges, loss of licensure, and reputational damage, all of which can cost a lot of money.

Make regular compliance assessments a standard practice, as healthcare regulations frequently change.

How to Improve Your Salary as a Medical Practice Owner?

Your medical practice is working and is making a decent ROI.

You have paid your bills, taxes, staff salaries, and pretty much every mandatory expense. However, that doesn’t mean that the remaining sum is your net profit.

On paper, it is indeed the practice’s net profit, but if you don’t allocate some of that to reinvest into your practice, your salary ceiling will hardly rise.

Accordingly, the first step in improving your salary as a practice owner is to determine the balance between personal salary and practice reinvestment.

This depends on the practice’s maturity, debt obligations, and growth goals.

A good benchmark to calculate your salary is to allocate 50-70% of your final net income as your salary, and 30-50% to reinvest into your practice.

- Operational costs

- Marketing

- Technology upgrades

- Staff training

- Quality control

Note that newer practices often reinvest more. Your primary concern as your practice grows is to sustain it long enough.

Avoid the common mistake of taking too high a personal salary in the early stages, which can limit your practice’s growth potential.

This can be a little tricky to adjust if you’re still starting up, which is why consulting a professionalis highly recommended.

With that out of the way, it’s time to focus on the practical aspect.

Let’s assume that you’re a primary care or a family doctor and you have a private practice that yields $250,000 a year (close to the national average).

Besides the patient retention optimization that we’ve mentioned earlier, here’s what you can do to push up that number:

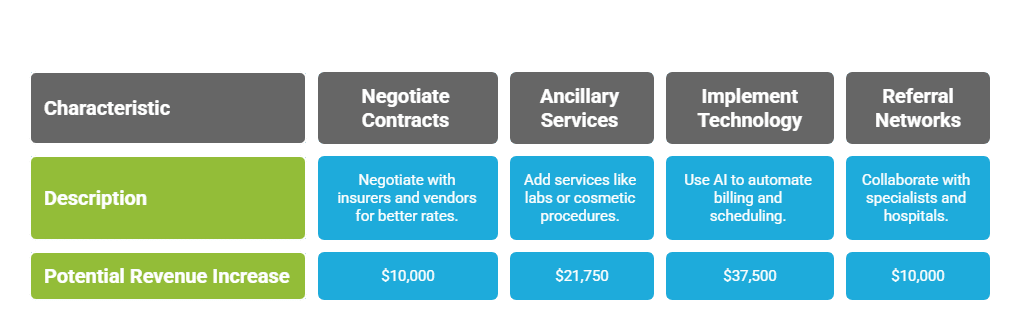

1. Negotiate Favorable Contracts with Insurers and Vendors

Focus on private and commercial insurers as they provide a high reimbursement rate.

Try to regularly negotiate your contracts to reflect updated procedural codes, regional cost-of-living adjustments, or specialty-specific demand.

For example, securing just a 10% rate increase from your largest payer could directly boost revenue by thousands of dollars a year.

To be conservative in our estimates, let’s say you could gain $10,000 in additional revenue from improved insurance contracts.

You can also audit expenses like medical supplies, EHR subscriptions, and facility leases.

Switching to bulk purchasing or renegotiating service terms could save thousands every year. We’ll keep it low at just $5,000 for now.

Note: Contract negotiation isn’t something that everyone can do. You’ll need someone with a high level of contract understanding if you want to get the best possible rates.

2. Increase Revenue by Adding Ancillary Services

Your practice doesn’t have to be restricted to your specialty. You can add additional services like in-house labs, cosmetic procedures, or chronic care management programs to generate supplemental income.

Another low-risk addition you can provide is Botox injections. The popularity of Botox has skyrocketed, with a 459% increase in annual injections between 2000 and 2020.

Plus, the average Botox injection costs around $435; only 50 injections a year translate into $21,750.

3. Implement Technology to Reduce Administrative Waste

Investing in AI-automated billing systems is the future, and there’s no way around it. AI-driven scheduling tools can cut administrative costs by 15-20%.

Applying that on our $250,000 practice, here’s what you can save:

- Lower end (15%): $250,000 * 0.15 = $37,500

- Higher end (20%): $250,000 * 0.20 = $50,000

As usual, we’ll stick to the lower end to keep our expectations manageable. So far, we’ve raised our annual income by $10,000 + $5,000 + $21,750 + $37,500 = $74,250 . Our $250,000 yearly revenue is now $319,250.

4. Don’t Ignore Referral Networks

You must collaborate with specialists or local hospitals to become a preferred provider for specific conditions, like diabetes management or post-surgical care, for example.

When your practice name becomes preferred in a certain medical field, you’ll have patients walking through your door on their own.

It’s hard to put a number on how many referrals you can generate, as this largely depends on how many referrals you’d get. However, you can expect a few thousand, so let’s maintain the minimum margin and say only $10,000 .

On applying these four tried-and-tested approaches. Our $250,000 practice jumped to $329,250 . That’s a 31.7% increase, and we were constantly calculating with low values in mind.

Don’t Leave Money on the Table

You’d be surprised how much money you’re losing when you’re not optimizing your practice’s revenue. Don’t focus too much on the startup costs of starting your own practice, and ignore the many factors that go into making an ideal financial plan.

The process is difficult, and even with previous experience, there’s no way around making financial mistakes; some of which can be detrimental.

Don’t leave the success of your practice to luck, and don’t leave money on the table. Collaborate with Physicians Thrive, and we’ll show you everything you need to know to financially succeed in owning a practice.