Key Takeaways

- Mortgage interest deduction (MID) lowers taxable income if you itemize deductions.

- Itemized deductions must exceed the standard deduction for MID to be beneficial.

- To qualify, the loan must secure a home used as your residence.

- MID rules vary by loan purpose, date, and filing status; consult a tax expert.

If you’re a homeowner, a home mortgage interest deduction can help you maximize your tax benefits if you use it right.

In today’s guide, we’ll explain how the mortgage interest tax deduction works, including important considerations for both acquisition debt and home equity loans.

While many homeowners primarily focus on their regular mortgage insurance premiums and interest payments, the rules surrounding deductible mortgage interest have evolved significantly in recent years.

Whether you’re managing a traditional home mortgage interest obligation or considering the implications of a home equity loan, getting the hang of these deductions can significantly impact your financial planning.

Our guide will walk you through all the aspects of these deductions to help you understand equity loans and mortgage-related tax benefits, so you can optimize your financial position.

Table of Contents

What Is Mortgage Interest Deduction?

Mortgage interest deduction, or MID, is a valuable tax benefit available to many homeowners in the United States.

It allows you to deduct the interest on your mortgage loan from your taxable income, which can lower your overall tax liability.

This can result in a significant amount of financial breathing room, especially in the early years of the mortgage, when a massive portion of your payments goes toward interest.

However, for that to happen, you will need to itemize your deductions.

We’ll explain what this means, but you need to understand something else beforehand.

The IRS uses a figure called the Adjusted Gross Income (AGI), which is your total income minus specific deductions.

There are two types of deductions available in the United States financial system: standard deductions and itemized deductions.

Standard Deductions

The standard deduction is a fixed dollar amount that the IRS allows all taxpayers to deduct from their AGI.

It simplifies the tax filing process by providing a single deduction amount based on your filing status (single, married filing jointly, head of household, etc.).

You don’t need to track specific expenses or gather supporting documentation to claim the standard deduction.

In other words, it’s a “one-size-fits-all” approach designed for simplicity.

Note: Standard deduction amounts are adjusted annually to take inflation into account.

Itemized Deductions

Itemizing, on the other hand, involves listing out specific expenses that the IRS allows you to deduct. These can include:

- State and local taxes (SALT): limited to $10,000 per household.

- Mortgage interest: (the MID we’ve been discussing).

- Charitable contributions: donations to qualifying charities.

- Medical expenses: Expenses exceeding a certain percentage of your AGI.

To itemize your income, you must keep records of these expenses throughout the year; then you have to use Schedule A (Form 1040) to list these deductions on your tax return.

This may sound like a hassle, but itemizing helps you decide whether you should continue doing it (since you can’t take both standard deduction and itemized deduction).

- If your total itemized deductions are greater than the standard deduction for your filing status, you should itemize. This means you’ll use Schedule A to list your deductions (including mortgage interest). In this scenario, your MID will directly reduce your taxable income and potentially lower your tax bill.

- On the other hand, if your total itemized deductions are less than the standard deduction for your filing status, you shouldn’t bother with itemizing, as it won’t provide any additional tax benefit, and you’ll be tracking everything for no reason.

Let’s have a quick example for each scenario. We’ll assume that the standard deduction for your filing is $13,850.

Scenario 1

You have $15,000 in itemized deduction, including $10,000 in mortgage interest.

In this case, you should itemize because $15,000 is greater than $13,850. You would deduct the full $10,000 in mortgage interest in this case.

Scenario 2

In this case, you have $12,000 in itemized deductions, including $10,000 in mortgage interest.

You should take the standard deduction of $13,850 because it’s higher than your total itemized deduction.

Even though you paid $10,000 in mortgage interest, you won’t get any additional tax benefit from it because you’re already taking the larger standard deduction.

To sum up, MID only helps if itemizing saves you more money than the standard deduction.

How to Qualify for Mortgage Interest Deduction?

Itemizing is a means of helping you decide which type of deduction you will choose. However, there are some criteria that you need to meet to qualify.

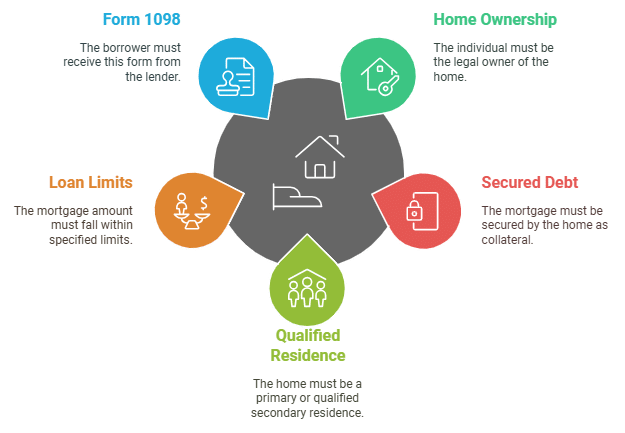

1. You Must Be the Home’s Owner

The only home that you can use MID benefits for is your own.

You, or you and your spouse (if filing jointly), must be the legal owner(s) of your home.

2. The Debt Must Be Secured by Your Home

This means that the mortgage loan is tied to your home as collateral. If you fail to repay the loan, the lender can foreclose on your property.

This is typical for most mortgage loans used to buy, build, or substantially renovate a home.

Accordingly, the loan can only be used for the aforementioned conditions to qualify (buy, build, or renovate).

It will not qualify for MID if it’s used for any other purpose, even if it meets all other criteria on the list.

3. The Home Must Be a Qualified Residence

The home must be a place of residence that belongs only to you. It can be your main home or second home (a second home can be a vacation home, but can’t be rented out to others).

4. Loan Limits Apply

Any mortgage taken out after December 15, 2017, can have deducted interest on the first:

- $750,000 of mortgage debt if you’re filing as single, married, or joint head of household.

- $375,000 of mortgage debt if you’re married filing separately.

Any mortgage taken out before December 16, 2017, can deduct higher amounts, as the mortgage interest deduction limit was considerably higher at the time ($1 million for single/joint filers and $500,000 for married filing separately).

5. You Must Receive Form 1098

This one is almost always a given, but we’re mentioning it for inclusion purposes.

Your mortgage lender will send you Form 1098, Mortgage Interest Statement if you spent $600 or more in mortgage interest payments during the year.

This form reports the amount of interest you paid and is essential for claiming the deduction.

Frequently Asked Questions

If I Refinance My Mortgage, Does That Affect My Ability to Claim the Mid?

Refinancing your mortgage generally doesn’t disqualify you from claiming the MID.

However, specific rules apply to deducting points paid during refinancing, so it’s important to consult a tax professional or IRS resources for guidance on those rules.

Can I Deduct the Interest on a Mortgage for a Rental Property I Own?

While you can deduct mortgage interest on a rental property, it’s treated differently than the MID for a primary or second home.

It’s considered a business expense and is reported on Schedule E ( Form 1040 Supplemental Income and Loss) rather than Schedule A.

What if I Share a Mortgage With Someone Who Isn’t My Spouse? How Does the Mid Work?

If you share a mortgage with someone other than your spouse, you can generally deduct the portion of the mortgage interest you paid.

You’ll need to agree on how to split the deduction and ensure the total claimed doesn’t exceed the actual interest paid.

I Used a Home Equity Loan to Consolidate Credit Card Debt. Can I Deduct the Interest?

Interest on home equity loans is deductible only if the funds are used to buy, build, or substantially improve your home.

If used for other purposes, like debt consolidation, the interest is usually not deductible as mortgage interest.

My Mortgage Interest Is Less Than the Standard Deduction. Should I Still Keep My 1098 Form?

Yes, you should always keep your 1098 form even if your mortgage interest is less than the standard deduction.

It’s an important tax document and may be needed for other purposes, such as verifying your mortgage balance or in case of an IRS audit.

Closing Words

Even with the simplest explanation possible, the mortgage interest deduction is a complicated matter that needs careful consideration because of the countless ins and outs involved with it.

You’ll need a tax professional to help, or at least someone who knows what they’re doing, to avoid wasting time and money.

Also, if you’re here, you’re most likely a physician or someone who works in the healthcare industry.

As such, you probably have student loans or money reserved for continuing education, which makes your need to save money even more critical.

Physicians Thrive is here to help you go through that highly confusing journey.

We are a team of expert physicians whose purpose is to guide younger physicians to thrive while building their careers.

Contact us now to get a free quote and get a feel of what we can do.