Putting down just $60,000 to receive your own house with a mortgage seems like the sweetest deal ever.

The excitement with the idea can leave you unaware of the hefty monthly costs that you may underestimate or miscalculate.

The situation can get even more unpredictable if you’re settling for an adjustable-rate mortgage, where there are too many variables to handle without mistakes.

Fortunately, you can narrow down the mistakes by using a simple mortgage calculator.

However, it’s still, at the end of the line, a calculator. If you input the wrong data, you’ll get the wrong results.

This is why we created this guide to help you understand how mortgage calculators work, so you can make the most out of any calculator you find online.

Plus, we’ll give you a tip to help you get a calculator that considers every single financial variable.

Key Takeaways

- Mortgage calculators simplify budgeting but depend on accurate data for reliable results.

- Fixed-rate mortgages offer stability; adjustable-rate mortgages involve fluctuating interest costs.

- Calculators overlook key variables like taxes, insurance, and future financial changes.

- Customized tools or expert guidance ensure tailored financial planning for mortgage success.

Table of Contents

Mortgages 101: What Does That Even Mean?

A mortgage is a loan that lets you buy a home without paying the full price upfront.

You put in a down payment, then borrow money from a bank or a mortgage lender and agree to pay it back over time, usually over 15 to 30 years.

Your home acts as a guarantee for the loan, which means the lender can take it if you stop making payments for any reason.

Generally, there are two types of mortgages that you can use:

Fixed-rate Mortgages

This type of mortgage keeps the interest rate the same for the entire loan period, regardless of how long or short it is.

Your monthly payments stay the same, making it easier to plan your budget.

This is a good choice if you want stability and plan to stay in your home for many years.

In many cases, you won’t even need a mortgage calculator for this one; a simple formula of evenly dividing the loan over the loan period is all you need.

Adjustable-rate Mortgages

Ajustable-rate mortgages start with a lower interest rate that changes over time based on market conditions.

Your monthly payments can go up or down depending on the economy.

People pick this option if they plan to sell their home or refinance within a few years.

Also, this is the type of mortgage that’s a little complicated to predict in the long run. That’s when mortgage calculators can really help.

Before we explain how mortgage calculators work, you need to understand a few terms that we’ll use:

- The principal: The amount you borrow to buy your home. If you buy a $300,000 house and put down $60,000, your principal is $240,000.

- Interest rate: The amount that the lender charges you to borrow money. A 5% interest rate means you pay an extra 5% of your remaining loan balance each year.

- Term: This is how long you have to pay back the loan. A 30-year term spreads your payments over 30 years, while a 15-year term means higher monthly payments but less total interest.

- Credit score: The number that reflects your creditworthiness. A higher score can lead to better loan terms and lower interest rates.

- Property tax: Local tax based on your home’s assessed value.

- PMI (Private Mortgage Insurance): This is a type of insurance required if your down payment is less than 20%. It protects the lender in case you default and adds to your monthly payment. It’s also mandatory for FHA loans (Federal Housing Administration).

- Homeowners insurance: This is a type of insurance that protects you, as a buyer, against damage or theft of your belongings in the house.

- HOA fees: The homeowners’ association fees are charged for properties in community associations that cover maintenance and amenities.

How Does a Mortgage Calculator Work?

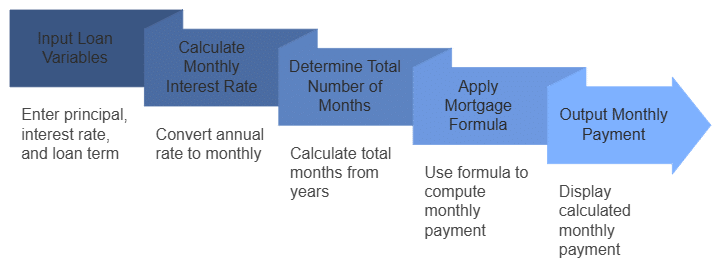

A mortgage calculator takes the multiple variables in your loan terms and turns them into measurable amounts for each month that you can predict and prepare for over the loan period.

To do that, mortgage calculators use a standard mortgage payment formula that goes like this:

M = P * (r * (1 + r)^n) / ((1 + r)^n – 1)

Where:

- M is your monthly payment

- P is the principal

- r is the monthly interest rate (yearly rate divided by 12)

- n is the total number of months (years multiplied by 12)

Let’s test it out.

We’ll assume that you’re buying a house at the current average U.S. home price, which is $359,099.

If you make a 20% down payment of $71,820, the calculator will use $287,279 as the principal (P).

The interest rate (r) shows how much extra you will pay to borrow the money; the calculator needs this rate as a percentage, like 6.5%.

Some calculators allow you to enter that as a number as well, which will be $18,673 in this case during the first year alone, which works out to about $1,556 in interest in your first monthly payment.

Note: This amount gradually decreases as you pay down your loan.

The loan term (n x 12) sets how many years you’ll take to pay back the loan.

Most people pick between 15–30 years (180–360 months). Longer means lower monthly payments but more interest in total.

Once you put in these three numbers, the calculator does all the work.

It figures out how to split your loan into equal monthly payments that will pay off both the principal and interest by the end of your term.

This makes it much easier to figure out if you can afford the home you want.

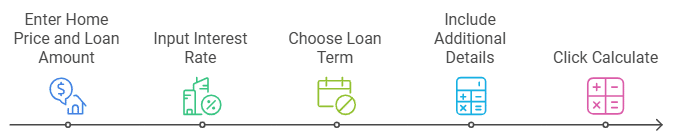

Step-by-Step Guide to Using a Simple Mortgage Calculator

Now that you understand how the calculator works, let’s see how to use it.

We’ll be referring to our previous home example price while using Bankrate’s Mortgage Calculator as our default calculator.

Step 1: Entering the Home Price and Loan Amount

Enter your home price, followed by the exact loan amount.

Subtract your down payment of 20% of $71,820 from the house’s price of $359,099, and you get $287,279 as your loan amount.

Step 2: Inputting the Interest Rate

Enter your interest rate as a percentage (like 6.5%) or a decimal (0.065), depending on your calculator.

Make sure you’re using current market rates or the specific rate your lender offered.

Step 3: Choosing the Loan Term

This one is easy. Enter how many years you will be paying your loan. We’ll be using 30 years for this example.

Note: Some calculators may also require you to enter the Zip Code.

Step 4: Include Additional Details

At this point, you can click calculate and be done with it. However, some variables can make the final result a lot more accurate.

Click on the “Taxes, insurance, HOA fees” tab, and you’ll be prompted to enter your credit score, property tax, Homeowner’s insurance, private mortgage insurance (PMI), and HOA fees.

Note that adding the credit score and property tax are the most important tabs here.

You can still purchase a house and not pay private mortgage insurance, homeowners insurance, or HOA fees.

In other words, these three tabs are situational.

Once you’re done, click “Calculate.”

Common Mistakes to Avoid When Using a Mortgage Calculator

You’d be surprised how a small mistake can disrupt your entire mortgage plan over the years.

Mistakes don’t necessarily mean that you entered a wrong value by mistake, but they could also mean you’re using outdated rates or rates from general online sources that don’t match your specific situation.

For example, even if this article fully describes your individual condition, the rates might be outdated if you’re reading it two years after publishing it.

Let’s look at a small example to show you why we are emphasizing it this much.

A difference of just 0.5% on our example of a $287,279 loan can change your monthly mortgage payments by about $85, which will reflect over the years.

Other Variables

You should also consider property taxes and future financial changes.

Many homebuyers focus only on principal and interest payments while ignoring other required costs.

Property taxes often add several thousand dollars per year to your housing expenses.

In our example, property taxes of $3,600 and insurance of $1,200 annually add $400 to your monthly payment.

The lender will usually require these payments along with your mortgage into an escrow account.

Future financial changes are also a factor Property taxes might increase over time, and insurance premiums often go up yearly.

If you choose an adjustable-rate mortgage, your interest rate could rise over time.

In Conclusion

As you can see, while a monthly mortgage payment calculator can be pretty handy, it doesn’t guarantee that you’ll nail your mortgage plan, especially if you’re using an adjustable-rate mortgage plan where many variables come into play.

There are also other variable factors that mortgage calculators don’t consider.

For example, if you’re a physician, you’ll often have student loans and other educational expenses to worry about.

In other words, you need a fully-fledged calculator that works for your particular situation to help you foresee your future payments and win financially while you’re at it.

This is our prime goal at Physicians Thrive. We’re a team of physicians who help other physicians manage their financials in a world where everything is trying to take your money.

Contact us to get started, and we’ll sort everything up with you.