Protect Your Money

Services • Insurance • Life Insurance • Permanent

Get Your Free Life Insurance Quote

Permanent life insurance allows physicians to diversify and supplement their retirement income with the cash value of a life insurance policy. Talk to an advisor to learn about what permanent life insurance options are right for you.

Protect Your Loved Ones

Get Life Insurance Coverage Today

See All Your Options

Our experts present all the options so the freedom to choose the best policy for you is always at your discretion.

Coverage For Life

The main benefit of permanent life insurance is in the name, there is no end date. Your beneficiaries will collect your death benefit no matter when you die.

Tax Deferred

You won’t pay taxes on the money while it’s accumulating and, if you hold the account until its maturity date, you can borrow against that cash value tax-free.

Why buy permanent life insurance?

Permanent life insurance is an umbrella term and there are several variations and options to consider when shopping for permanent life insurance including whole life, universal life, adjustable life, variable life, and indexed universal life.

Whichever type of life insurance you choose, permanent life insurance works as follows:

With some plans, you pay a set amount in monthly premiums for a set amount of coverage for the remainder of your life. If you contribute more than your monthly premiums, the excess contribution will accumulate cash value in a cash account. Your beneficiaries will collect your death benefit no matter when you die.

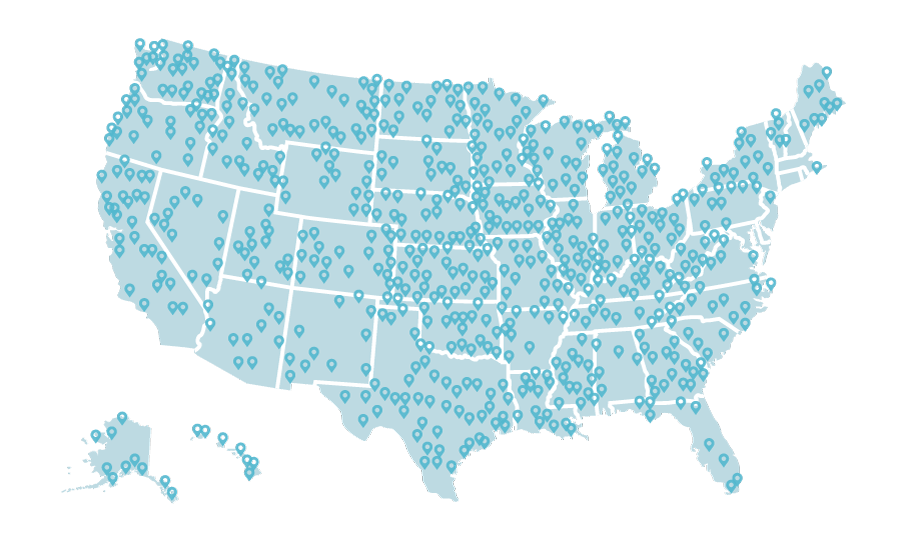

7,000+ satisfied physicians

Get Ongoing Service.

For no extra cost to you, our advisors advocate for you for the life of your insurance policy. In the case you need to put your policy to use or have questions about your coverage at any time, we are here for you.

We’ve Placed Billions of Dollars in Life Insurance Coverage.

Our team has worked with thousands of physicians to find their option for life insurance.

$3.3 Billion

and counting…

Get Free Life Insurance Quotes

Permanent life insurance is not a one-size-fits-all solution, and it is certainly not appropriate for every investor. Your life insurance choices may make the difference in your family’s lifestyle after a tragedy strikes by paying the bills, financing children’s educations, and protecting your spouse’s retirement. Request a quote and our team will review each element of the plan and the cost associated with it. We’re here to help you evaluate the value and build unique, cost-effective coverage tailored to you and your family’s needs.