Investing in real estate has a reputation for being the game of the rich.

However, anyone who follows the right steps can become rich thanks to real estate, not just those who start off wealthy.

Still, the process is far from easy and takes a lot of preparation and starting capital.

In this guide, we’ll give you an idea of what buying an investment property looks like.

We’ll show you what you should consider, how to calculate your assets, and how to make a detailed progress plan.

Key Takeaways

- Investment properties require higher down payments, stricter loan terms, and ongoing maintenance costs.

- Long-term real estate investments offer stable returns, but short-term market fluctuations exist.

- Taxes, property management, and vacancies impact overall profitability in real estate investing.

- Physicians can succeed in real estate with expert guidance and strategic financial planning.

Table of Contents

Is Buying an Investment Property for You?

Buying an investment property isn’t like buying one to live in.

An investment property is a real estate property that you purchase for one of two possible reasons: renting it out or selling it later to profit.

On paper, that may sound like a guaranteed investment with a decent passive income.

That can be true, but only if you’re willing to go through what’s needed to purchase, manage, and utilize an investment property well enough to earn a reliable income.

Here are the factors you need to consider:

Mortgage

Acquiring a mortgage for an investment property is a bit different from acquiring a primary residence.

Typically, you can expect fairly low down payments for residential properties.

Sellers know that it’s your first house and that you may not have the capital to pay a lot, so you’re given a decent break there.

However, buying an investment property means that you have a profit mentality and the funds to back it up. In other words, expect the down payment to go from the average 10% to around 20-25%.

The real impact of a percentage doesn’t register unless you apply it, so let’s take the average property price in the United States, which is a bit over $354,000 in 2025, as an example.

That 20-25% means you need around $70,800-$88,500 just as a down payment. That’s well over the annual salary of the average U.S. citizen.

Plus, in addition to the higher down payment, investment properties typically come with higher mortgage interest rates compared to primary residencies, due to perceived higher risk levels by mortgage lenders.

Being a Property Manager

If you or anyone you know has rented a property before, then you have a good idea of the hassle that landlords can go through, from managing sudden plumbing issues to dealing with summer infestations.

Besides the physical hassle, there are the maintenance costs. HVAC, electrical, and plumbing systems will undergo wear and tear, even when they’re properly used.

This can get expensive, and you should allocate 1-2% of your property’s value for annual maintenance.

In our $354,000 example, that’s $3,540-$7,080 a year or $295-$590 a month.

There’s also the process of finding a suitable tenant, which can be a headache on its own.

Plus, you have to be okay with the fact that your property won’t always have a tenant, which can set your earnings back for an indefinite period every year.

The Long Term ROI

Many people mistake real estate investment for a way to make a quick buck, which can be a fatal mistake for those who can’t financially sustain their properties long enough to make a profit.

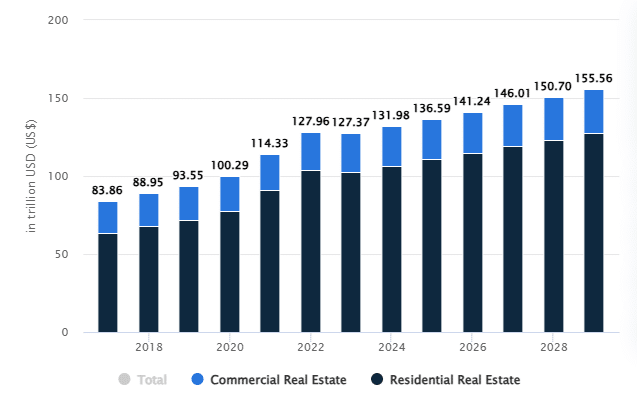

Still, the real estate market value has been steadily increasing over the years. Have a look at this table, and you’ll notice the constant growth.

Table by Statista

On paper, this table shows constant growth, which makes sense if we talk about the value over the years.

So, why wouldn’t it make sense to use investment properties as a means of short-term ROI?

The answer is short-term fluctuations, which can quickly break down your investment within a few months but not show up on a 10+ year scale like the one we just showed.

Take COVID-19, for example, which dropped rents in high-density areas across the nation by over 10%.

If you were considering a quick return or flipping properties at the time and you didn’t have emergency funds, you may have faced a financial crisis.

Note: This doesn’t mean that flipping properties isn’t lucrative, but the real value of real estate comes from long-term investments.

Taxes and Fees of Investment Properties

Taxes and fees for real estate investment properties can be deal breakers for new investors.

These expenses can be highly variable, which makes it difficult to get an accurate estimation of how much money you need to set aside for them.

Still, we can help you form a good idea of what you’ll need by listing all the primary taxes and fees required by rental property owners.

Property Taxes

Property taxes are annual expenses based on the assessed value of your property.

Rates can vary considerably by state, going as low as 0.32% in Hawaii and as high as 2.23% in New Jersey. In our $354,000 example, that’s as low as $1,132 or as high as $7,894.

Income Tax

Not every penny you earn from your rentals goes into your pocket.

Rental income from your investment property is taxable at your marginal rate. The marginal rate is the tax rate applied to the last portion of your income.

This is typically between 10% and 37%, depending on where you live and how much other income you have, apart from the passive income coming from the property.

The range is so wide due to how the marginal rate uses tax brackets and progressive systems to work.

Here’s a simplified tax system utilizing marginal rate brackets:

- $0 – $10,000: 10% tax rate

- $10,001 – $40,000: 20% tax rate

- $40,001+: 30% tax rate

In other words, if your income falls within the $10,001 to $40,000 range, that portion of your income will be taxed at 20%.

Capital Gains Tax (CGT)

If you sell the property for a profit after holding on to it for a while (typically more than a year), you’ll be subjected to capital gains tax.

CGT is the amount of money you pay when you sell an asset for profit, and it varies depending on the filer’s income.

This one can be difficult to understand, so let’s break down into simple points:

- Single filers pay no tax if their income is up to $48,350. However, if their income ranges between $48,350 and $533,400, they pay a 15% CGT, which increases to 20% if their income is over $533,400.

- Married couples who file jointly pay no tax up to $96,700. But, they pay 15% between $96,700 and $600,050 and 20% above that threshold.

- High-income earners are subjected to Investment Income Tax (NIIT) of 3.8%, which applies to capital gains for single filers earning over $200,000 or married couples over $250,000 annually.

Important note: Everything we’ve mentioned so far applies strictly to the U.S. tax system.

How to Buy an Investment Property

Real estate investing requires a good understanding of market dynamics, financing options, and property management basics.

Here’s what you need to be aware of before purchasing your first rental property:

Step 1: Understanding the Financial Requirements

Investment property loans have stricter requirements than regular home mortgages.

While excellent credit (above 720) will get you the best rates, many first-time real estate investors can successfully secure financing with scores of around 680.

The very first step is the down payment, which we’ll assume is 25% of the property’s value.

In our $354,000 example, that’s around $88,500 down payment plus approximately $17,700 for closing costs and initial reserves.

Investment Analysis

Let’s break down realistic numbers to determine the monthly income analysis for our $354,000 property.

Note that these are approximate numbers to give you an estimation and don’t cover every single variable in the market.

First, calculate your mortgage payment. After a 25% down payment ($88,500), you’ll have a loan of $265,500.

Assuming you have a 7% interest rate, this creates a monthly payment worth $1,765.

Then, we need to account for regular expenses.

Let’s take a middle ground percentage of property taxes at 1.2%, which effectively means $354 monthly ($4,248 ÷ 12).

Add a $150 monthly insurance and 0.5% ($1,770 ÷ 12) of the property value for maintenance and repairs, which comes down to $148 a month.

Lastly, there are potential vacancies. Even in strong rental markets, units occasionally sit empty between tenants.

Budget for around 8% of your rental income ($236) to cover these periods.

Put it all together:

- Monthly rental income: $2,950

- Total monthly expenses: $2,653 ($1,765 + $354 + $150 + $148 + $236)

- Expected monthly cash flow: $297

Step 2: Choosing Your First Market

Choosing your first investment market means focusing on the areas you know well, which are ideally within a 30-minute drive from your home or less.

This proximity makes it easier to check on your property and respond to any issues related to it, especially since you’re likely to manage it yourself, at least initially.

Your target market should have at least one of these indicators, or preferably both:

Rental Demand

Research the rental prices of similar properties in the area.

For a $354,000 property, you’d want to see comparable properties renting for at least $2,950 monthly (about 0.8% of the purchase price) to make the investment worthwhile.

A local real estate agent can greatly help you find this information through recent rental listings.

Employment Stability

Look for areas with diverse job opportunities. A neighborhood near multiple employers, like hospitals, universities, or business districts, tends to maintain a steady rental demand.

Step 3: Get Some Support

The margin for error is small in the real estate market, and new investors will almost always need professional help. Aim to find the services of:

A Real Estate Agent

A real estate agent will answer any questions to which you may not find answers online.

Plus, they will give you expert guidance on the indicators to look for and the type of market that suits your needs.

A Home Inspector

Find someone who can thoroughly examine your potential investment property and provide detailed reports on its condition, including its potential repair needs.

On a $354,000 property, you should expect to spend about $500-$700 on a quality inspection to save yourself thousands in unexpected repairs.

A Property Manager (Optional)

Even if you plan to self-manage initially, you should still consider interviewing several local managers to understand their services and fees, which typically range between 8-10% of the monthly rent.

You may not need property managers initially, but they will become real assets once you start managing multiple units.

Let the Professionals Help

The numbers are difficult, and there’s no way to sugarcoat it. Getting a good investment property that can generate a decent annual rental income from the first try without losing money is a long shot.

Your profession as a physician will complicate things even further. Your student loans, continuing education, and your personal expenses all add up even more figures to the whole calculation.

The good news is that physicians can still succeed in the real estate market with adequate guidance, and that’s what we do best at Physicians Thrive.

Contact us, let us know of your financial situation and real estate goals, and we’ll help you get the best deals and aid you with legally taking advantage of tax deductions.