Manage Your Money

Services • Investments

Build and Secure Wealth

Investment Management For Physicians

Investing is an essential step in building long-term financial security. At Physicians Thrive, we offer personalized investment services designed specifically for medical professionals.

Our strategies address the unique challenges and opportunities physicians face, helping you grow and protect your wealth with precision and confidence.

How It Works

Physicians Thrive simplifies the complexities of investment planning, offering physicians bespoke solutions that align with their career stage, financial goals, and risk tolerance.

From personalized portfolio management to tax-efficient strategies and real estate investments, we integrate your investments with your broader financial plan for holistic wealth growth.

With expert fiduciary guidance, you can confidently build and secure your financial future.

Tailored Portfolios

Personalized investment plans designed to meet your financial goals, risk tolerance, and career trajectory.

Tax-Efficient Strategies

Minimize tax liabilities with smart asset allocation, tax-loss harvesting, and strategic planning.

Diversified Options

Explore traditional investments, real estate, and alternative assets to optimize growth and stability.

Individualized Investment Strategies

Physicians Thrive provides a wide spectrum of investment options that allow for us to develop a strategy that works for your individual risk tolerance and financial goals. When you work with a Physicians Thrive advisor you can rest assured that your money is being put to work in the most efficient way possible.

A Broad Spectrum of Solutions

Our investment team offers a wide range of investment options that offer an array of customizable solutions to suit any risk tolerance, investment objective, and timeline, as well as the ability to use multiple strategies inside one account.

These solutions include:

- Tax Efficient Investing

- Exchange-Traded Funds (ETFs)

- Open Architecture

- Passive + Active Blend

- ESG (Environmental, Social, and Governance) Investing

- Strategic + Tactical Blend

- Access to well known effective money managers like Blackrock and Vanguard.

- Access to structured notes

Easily Measure and Assess Your Financial Health

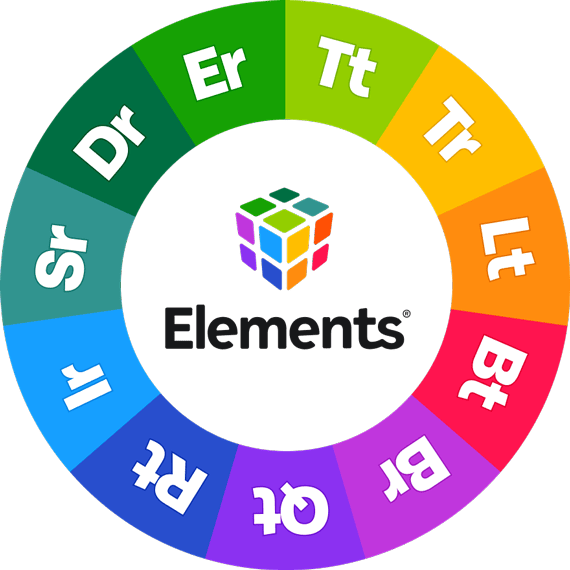

Physicians Thrive uses a financial planning system called Elements® to collect your financial information and measure the key indications for your financial wellness over time.

The Elements Financial Planning System™ gives us a real-time scorecard of your financial situation, so we can continually monitor your progress and provide ongoing, informed advice.

You can review these indications by exploring the Elements below:

- Are you taking the right amount of risk?

- Are you using your income wisely?

- Do you have the right mix of assets?

- How much wealth do you need to make work optional?

As we work together your financial plan will need regular course corrections to keep you on the right track.

That’s why each month we assess your overall financial health using the Elements scorecard and also focus in on one Element for which we collect updated data and do a deeper analysis.

Finally, we deliver beautifully designed, easy-to-follow reports that feature your very latest stats, scores, and any new recommendations for improving your plan.

This methodical approach to keeping your data up-to-date and refreshing your financial plan will give you complete confidence in your progress and direction.

1

Organize

Together, we’ll gather and organize your financial information upfront.

Then, our app will help keep your data up-to-date with prompts when things get stale.

2

Analyze

We’ll regularly analyze your financial health scores to identify ways to help you improve.

And each quarter we’ll deliver a report through our app that highlights all the progress you’ve made.

3

Decide

We’ll use your performance summary and progress report to help you decide if any adjustments should be made to your plan.

We’ll share recommendations with you by email, video, or phone.

4

Act

As the point person on your financial plan, your advisor will:

- Assign action items to our internal team

- Facilitate conversations with your other service professionals

- Introduce you to approved industry partners

Frequently Asked Questions

What makes our investment services unique?

Our team understands the unique financial challenges physicians face, such as fluctuating incomes and high student loan debt. We craft strategies specifically tailored to medical professionals.

Do you provide advice on real estate investments?

Yes, we guide physicians in real estate investments, from residential properties to commercial opportunities, ensuring alignment with your financial goals.

How do tax-efficient strategies work for investments?

We optimize your portfolio by placing tax-inefficient assets in tax-advantaged accounts and employing techniques like tax-loss harvesting to maximize after-tax returns.

How should I diversify my portfolio?

A diversified portfolio is achieved by holding a mixture of assets such as stocks, bonds, mutual funds, exchange-traded funds and also across a variety of different sectors. You should also consider growth versus value and the size of the company you are investing in.

Does Physicians Thrive have access to private equity investments?

Yes. Our team has non-publicly available investments available for our clients.

How often can I meet with my advisor to review my portfolio?

Our rule of thumb is that you can meet with your advisor ss often as you want. For many physicians, that means meeting monthly or quarterly. This also may depend on what circumstances are happening in your life; change in employer, if your family is growing, funding a family members education, etc. or if major events are happening in the world that impact your investments.

At the minimum, we will want to review your portfolio annually.

How much can I afford to invest?

Physicians Thrive recommend building an emergency fund before you start investing. This should include 3-6 months of your average monthly expenses and spending that you can tap into if something unexpected happens.

Our team also recommends prioritizing credit card debt repayment first before investing.

If you have student loans, you don’t have to wait until they are completely repaid to begin saving. Start investing when the growth of your investments can double the rate of interest costs on student loans. In many cases it’s a better strategy to invest and repay your student loans at the same time.

If you have access to an employer matched retirement plan, prioritize contributing there first.

Related Services

We’ve worked with thousands of physicians across the country

Physicians Thrive is a dynamic, full-service financial planning company helping doctors take control of their money. You spend your days caring for everyone else – let us take care of ensuring your investments are in order.

7,000+ satisfied physicians