At Physicians Thrive, there is one investment pitfall that we see physicians struggle with so often, we gave it a special name: The Physician Tax Trap Triangle. The Tax Trap Triangle describes an imbalance of three key tax-advantages within a retirement portfolio. It also poses a critical risk to physicians’ long-term financial stability.

What is the Tax Trap Triangle?

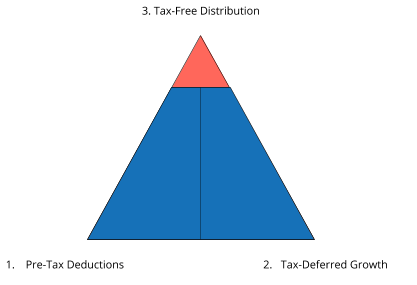

The Tax Trap Triangle describes a portfolio shortcoming where physicians find themselves surprised with an immense tax burden. Due to the composition of their retirement income. Imagine that each point on a triangle represents a different type of investment tax benefit:

The first type of tax-advantage is a pre-tax deduction. Contributions to tax-deductible investments, such as 403bs, 401ks and traditional IRAs, reduce your taxable income during the tax-year of the contribution. The second type of tax benefit is tax-deferred growth.

With tax-deferred growth, any growth of value within your investment may not be subject to taxes until you withdraw the money. It’s important to note that these first two tax-advantages are essentially delaying the payment of income taxes. You earn and grow money now, and you pay taxes on it later.

More Options

The final type of tax-advantage, tax-free distribution, reverses this timeline. Investment vehicles with tax-free distribution. Such as Roth IRAs, Roth 401ks and Roth 403bs, get funds with post-tax money. But allow investors to make tax-free qualified withdrawals during retirement. Physicians tend to overlook, shortchange or believe maxing out the Roth 401k is enough for this final category of investment. Thus leading them into the Tax Trap Triangle with little or not enough tax-free retirement income.

If all or most of your investments offer tax-advantages on the front end, you risk increasing your retirement tax burden beyond your means. A very common misconception among physicians is that maximizing 401ks, 403bs or 457bs provides enough of an asset base to fund retirement goals.

After helping thousands of physicians plan for their financial futures, we found almost all of them fell short of their retirement income needs. Especially when the primary investment and wealth accumulation strategy centered around the employer retirement plan. Even when those plans get maximized annually, the total dollars tend to only cover, at most, 50% of retirement income needs.

Why is the Tax Trap Triangle so risky?

When physicians pay far more in taxes than expected during retirement, this added expense can hurt their financial stability. Imagine if you’ve carefully budgeted for 25 years of retirement income. Only to realize that you will have to pay an additional 6% of your annual income on taxes. Depleting your savings earlier than expected can lead to a crisis in your final years of retirement.

Because physicians tend to be very high earners, many doctors mistakenly assume that they will qualify for a much lower tax bracket in retirement. When they are no longer earning their normal paychecks. As a result, it is common for doctors to overlook their retirement tax burden. Or presume it will be negligible. However, this is typically not the case. In reality, physicians’ tax burdens usually remain stable even when they stop working.

Doctors

Most doctors want to maintain a similar lifestyle as they transition into retirement. Which requires a significant amount of retirement income. If you want to live in a nice neighborhood, go out to eat, drive the same cars, and go on vacations, you can generally plan to spend at least 70% of your yearly income each year in retirement.

That means if you’re making $120,000 a year now, you will need at least $84,000 in annual retirement income to continue your current lifestyle. As you might imagine, it can be a nasty surprise to find yourself liable for income tax on $84,000 per year. If you were expecting to have a little to no tax burden.

In short, there is no way to anticipate your tax burden during retirement without proper planning. Parameters for different tax brackets change over time. And many physicians underestimate their retirement income needs. As a result, the best way to protect yourself from an unexpected retirement tax burden is to balance your portfolio. Using investments that allow for tax-free distributions. In this way, you can guarantee a source of tax-free income. Regardless of what changes occur with tax policy or in your personal life.

How can I Avoid the Tax Trap Triangle?

To avoid getting trapped with an overwhelming tax liability in retirement, physicians should add wealth accumulation strategies. They offer the final type of category of tax advantage: tax-free distribution. There are several strategies that offer tax-free distributions. Although certain options come with notable limitations.

- A Health Savings Account (HSA) is an account designed to help people with high-deductible health plans to cover the cost of approved medical expenses. If you are eligible for an HSA, you can make pre-tax contributions to your HSA and tax-free withdrawals for qualifying medical expenses. This can be a valuable asset for retirees. As they may have more healthcare-related expenses with age. This account can either be a cash-based account or investing can take place. Depending on the custodian used. Before investing these dollars that you may use for current medical expenses, we highly recommend speaking with a financial planner. They can help you weigh the pros and cons first before taking too much risk with money you may need to use for a medical emergency.

- A backdoor Roth IRA can provide another opportunity for tax-free retirement income by taking advantage of a tax loophole. Roth IRAs are investment accounts that offer tax-free growth. Once the account holder is over the age of 59½, tax-free withdrawals. However, Roth IRAs are subject to income limits. In 2019, only individuals with less than $137,000 single adjusted gross income or less. And $203,000 for those married filing jointly, got permitted to contribute directly to a Roth IRA. Typically, these income limits would disqualify most physicians from taking advantage of a Roth IRA. However, there is a “backdoor” way to access these benefits.

Backdoor Roth IRA

A backdoor Roth IRA offers a work-around strategy. In which the physician invests in a traditional IRA, and then converts the account into a Roth IRA. In the tax year of this conversion, the physician will pay taxes on the converted amount. And repay previously received tax-deductions for the initial traditional IRA contributions. You can contribute (and subsequently convert) up to $6,000 to a traditional IRA annually. Or $7,000 if you are 50 or older. After the required taxes on the converted money, your Roth IRA will accrue tax-free growth and offer tax-free retirement distributions.

While a backdoor Roth IRA is 100% legal, this strategy hinges on a tax loophole. Which could easily be closed in the future. Thus, while a backdoor Roth IRA can provide a helpful tax-free boost to your retirement income, it should not serve as a cornerstone of your retirement investment strategy. Due to its uncertain future and restrictive annual contributions.

Retirement

Keep in mind that you may not be subject to the conversion tax depending on the composition of your other retirement accounts. This is another area where it is best to speak with a financial planner to determine if you should make annual contributions and pay the conversion tax or avoid the conversion tax and use other tax free distribution strategies.

- Life Insurance Retirement Plan (LIRP), also known as non-qualified executive benefit plans, are a financial contract backed by insurance companies that can provide a substantial stream of tax-free retirement income for physicians. These are so common among highly compensated executives that approximately 70% of the Fortune 1000 companies provide these as part of their compensation packages. When you establish a LIRP, your contract consists of both a death benefit as well as cash-value in an equity index account. When structured properly, a majority of annual contributions into a LIRP goes towards the contract’s cash-value, and these funds grow tax-free in proportion to the performance of a designated index such as the S&P 500 or NASDAQ-100.

During retirement, a physician can withdraw the equivalent amount of their cash-value contributions from the contract without any tax liability. The physician can also borrow beyond that amount by making a tax-free “loan” from the gains within the account at a below-market interest rate.

Loans

These “loans” are essentially advances from the contract’s insurance benefit that will gradually reduce the insurance amount paid out at maturity. Provided that the account’s funding structure remains compliant with the tax code requirements and gets maintained until maturity, all distributions, advances, and payouts are tax-free.

While LIRPs are not an appropriate investment for everyone, physicians are often well-suited to reap the benefits of this product. As high-earners, physicians typically have excess earnings available to invest even after maximizing contributions to employer-sponsored plans. As a result, a LIRP can be a valuable addition to a physician’s investment portfolio and provide a substantial source of tax-free retirement income. To learn about one specific vehicle to use to set up a LIRP, read more about the right (and wrong way) to utilize an IUL contract.

Conclusion

Long-term tax reduction is a key component of retirement planning. The best way to protect your retirement lifestyle and avoid the Tax Trap Triangle is to balance your portfolio with investments that allow for tax-free distributions. To review your retirement plan and investment portfolio, talk with an advisor today.

Get Physician Specific Financial Planning

Work with advisors that know physicians.

Get Financial Planning

Need help with something else?

Get Free Disability Insurance Quotes

Get Your Contract Reviewed