Manage Your Money

Investments • Physician Investing Strategies

RSVP Here

nSight Surgical Event

Dr. Derek Amanatullah and his team are going to present the final demonstration of the nSight Surgical artificial intelligence technology before it is deployed in an operating room near you.

Individualized Investment Strategies

Physicians Thrive provides a wide spectrum of investment options that allow for us to develop a strategy that works for your individual risk tolerance and financial goals. When you work with a Physicians Thrive advisor you can rest assured that your money is being put to work in the most efficient way possible.

A Broad Spectrum of Solutions

Our investment team offers a wide range of investment options that offer an array of customizable solutions to suit any risk tolerance, investment objective, and timeline, as well as the ability to use multiple strategies inside one account.

These solutions include:

- Tax Efficient Investing

- Exchange-Traded Funds (ETFs)

- Open Architecture

- Passive + Active Blend

- ESG (Environmental, Social, and Governance) Investing

- Strategic + Tactical Blend

- Access to well known effective money managers like Blackrock and Vanguard.

- Access to structured notes

Easily Measure and Assess Your Financial Health

Physicians Thrive uses a financial planning system called Elements® to collect your financial information and measure the key indications for your financial wellness over time.

The Elements Financial Planning System™ gives us a real-time scorecard of your financial situation, so we can continually monitor your progress and provide ongoing, informed advice.

You can review these indications by exploring the Elements below:

- Are you taking the right amount of risk?

- Are you using your income wisely?

- Do you have the right mix of assets?

- How much wealth do you need to make work optional?

As we work together your financial plan will need regular course corrections to keep you on the right track.

That’s why each month we assess your overall financial health using the Elements scorecard and also focus in on one Element for which we collect updated data and do a deeper analysis.

Finally, we deliver beautifully designed, easy-to-follow reports that feature your very latest stats, scores, and any new recommendations for improving your plan.

This methodical approach to keeping your data up-to-date and refreshing your financial plan will give you complete confidence in your progress and direction.

1

Organize

Together, we’ll gather and organize your financial information upfront.

Then, our app will help keep your data up-to-date with prompts when things get stale.

2

Analyze

We’ll regularly analyze your financial health scores to identify ways to help you improve.

And each quarter we’ll deliver a report through our app that highlights all the progress you’ve made.

3

Decide

We’ll use your performance summary and progress report to help you decide if any adjustments should be made to your plan.

We’ll share recommendations with you by email, video, or phone.

4

Act

As the point person on your financial plan, your advisor will:

- Assign action items to our internal team

- Facilitate conversations with your other service professionals

- Introduce you to approved industry partners

Why Choose Physicians Thrive?

Balance

Our team knows it’s critical to protect our clients from the devastating impact large drawdowns can have on the long-term growth of an investment portfolio. We work with an investment team that has developed and implemented investment strategies specifically geared toward our client’s unique investment goals as well as their tolerance for risk.

Diversification

Our investment team’s approach is based on using varied strategies to help minimize risk. While each of our strategies has its own methodology, our focus is to avoid major losses. We believe that diversification across multiple risk-controlled strategies helps manage wealth for both performance and protection.

Managed Risk

In attempting to avoid large-scale losses, we utilize strategies that emphasize low correlation to broader volatile market activity, whether through hedged equity with the use of protective options, tactical strategies to dynamically adjust to market conditions, or other risk management practices.

Our Resources and eBooks

A Wealth of Knowledge

Browse More by

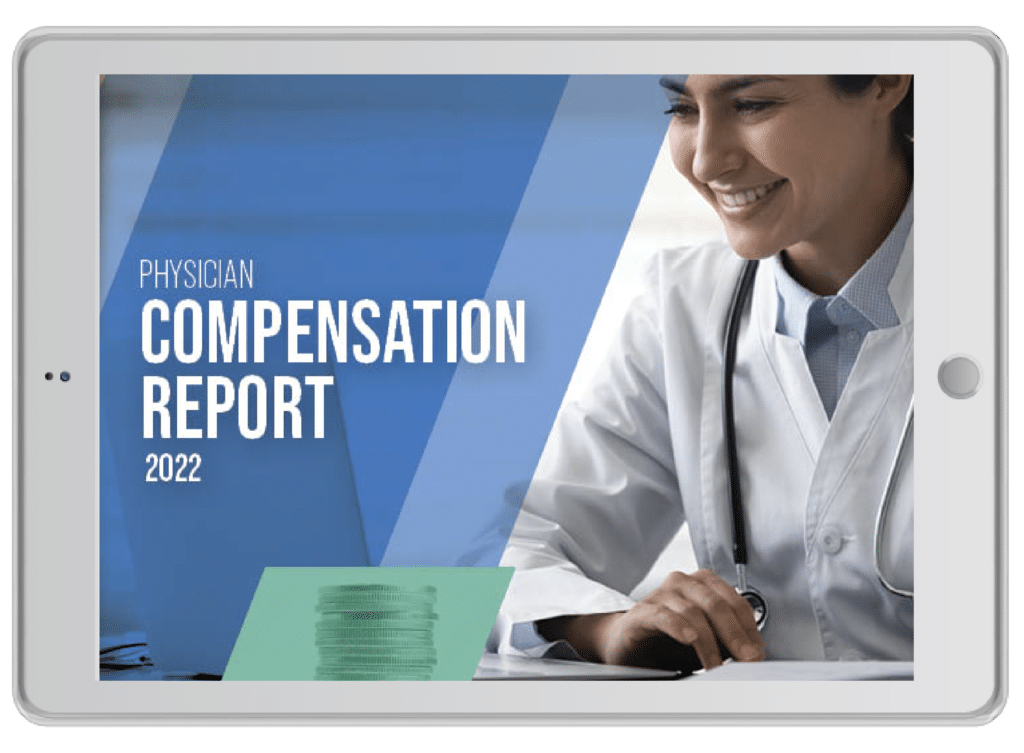

2022 Physician Compensation Report

How does your salary stack up against your peers?

Download the eBook

10 Best States to Practice Medicine

Choosing to pursue a career in medicine was the easy part. Deciding where you want to transplant your practice — and pos…

Read The Article

Contract Review: Exiting an Employment Agreement

It is crucial that you understand what is in your contract and what particular terms and conditions you should be aware of…

Download the eBook

10 Benefits of a Roth IRA

Why do so many people choose them over traditional IRAs? The IRA that changed the whole retirement savings perspective. Si…

Read The Article

Essential Elements of Financial Planning

Physicians Thrive compiled invaluable advise on what every physician should look for in their financial planner.

Download the eBook

The Physician’s Guide to Disability Insurance

Physicians have more at stake than any other profession. Protecting your income with disability insurance is critical for …

Download the eBook

The Physician’s Guide to Malpractice Insurance

Learn what every physician should know before they purchase malpractice insurance.

Download the eBook

3 Ways to Avoid Taxes on Life Insurance Benefits

Veronica Baxter | Boonswang Law Firm As a general rule, they do not tax proceeds from a life insurance policy as income to…

Read The Article

7 Alternative Jobs for Physicians

Are you burnt out from years of working long hours? Do you want to step away from clinical practice? You’re not alone. M…

Read The Article

How to Buy Into a Private Practice (Valuations and More)

As a physician in primary care or specialty care, there may come a time when you decide to go into business for yourself. …

Read The ArticleWe’ve worked with thousands of physicians across the country

Physicians Thrive is a dynamic, full-service financial planning company helping doctors take control of their money. You spend your days caring for everyone else – let us take care of ensuring your investments are in order.