Key Takeaways

- The average U.S. home price is $360,000 but varies widely by state.

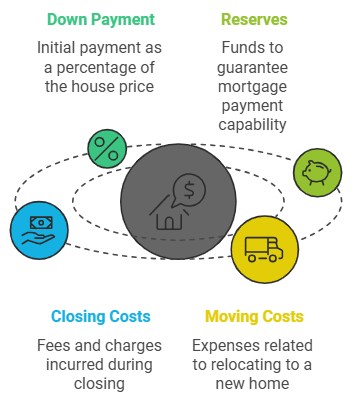

- Upfront costs include down payments, reserves, closing fees, and moving expenses.

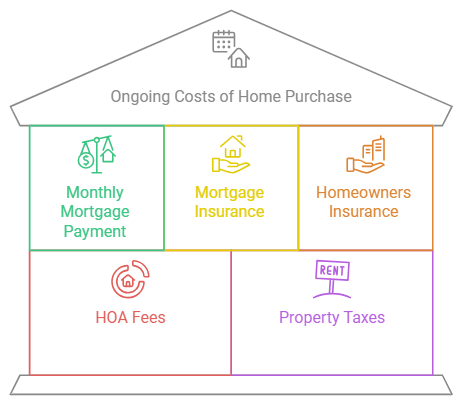

- Ongoing costs involve mortgage payments, insurance, taxes, and potential HOA fees.

- Economic factors, interest rates, and location heavily influence home affordability.

The cost of buying a home in the U.S. is around $360,000.

Even if you’re financially capable, there are many ins and outs in the home’s purchase price that you should consider to make the purchase process as smooth as possible.

In this post, we’ll unpack the average costs of buying a home in the United States, the factors contributing to the costs, and a complete breakdown of the purchase price, along with any hidden home-buying fees.

Table of Contents

What Is the Average Home Price in the United States?

According to Zillow’s Home Value Index (ZHVI), as published by the Federal Reserve’s ALFRED database (vintage July 17, 2025), the typical U.S. home value averaged $354,767 in 2023 and $366,578 in 2024. This is approximately a 3.3% increase from 2023 to 2024.

However, there can be great fluctuations in the typical U.S. home value depending on various factors. Additionally, the actual price of the house isn’t the only thing that you need to keep in mind.

Let’s begin with the reasons why home prices fluctuate throughout the nation.

Location

The state you live in is arguably the biggest contributing factor to how much a home will cost you.

For example, the average home in Alabama will set you back $228,283. Comparatively, a home in Colorado averages $563,964, and Hawaii is approaching the 1 million mark at $986,887.

Here’s the full list for reference:

|

State |

Cost |

|

West Virginia |

$168,166 |

|

Mississippi |

$181,695 |

|

Louisiana |

$204,977 |

|

Arkansas |

$209,299 |

|

Oklahoma |

$210,097 |

|

Kentucky |

$210,862 |

|

Alabama |

$228,283 |

|

Iowa |

$226,811 |

|

Kansas |

$232,507 |

|

Ohio |

$235,560 |

|

Indiana |

$245,505 |

|

Michigan |

$249,917 |

|

Missouri |

$252,431 |

|

Nebraska |

$265,433 |

|

North Dakota |

$268,647 |

|

Pennsylvania |

$271,911 |

|

Illinois |

$274,301 |

|

South Carolina |

$301,813 |

|

New Mexico |

$306,434 |

|

South Dakota |

$308,851 |

|

Texas |

$309,897 |

|

Wisconsin |

$313,952 |

|

Tennessee |

$323,646 |

|

Georgia |

$335,925 |

|

North Carolina |

$336,379 |

|

Minnesota |

$346,713 |

|

Wyoming |

$348,066 |

|

Delaware |

$390,830 |

|

Virginia |

$400,435 |

|

Vermont |

$404,238 |

|

Maine |

$405,684 |

|

Florida |

$418,097 |

|

Maryland |

$433,466 |

|

Connecticut |

$436,268 |

|

New York |

$452,823 |

|

Nevada |

$457,395 |

|

Idaho |

$461,661 |

|

Montana |

$473,023 |

|

Rhode Island |

$478,722 |

|

New Hampshire |

$505,012 |

|

Oregon |

$511,513 |

|

Utah |

$532,928 |

|

New Jersey |

$550,459 |

|

Colorado |

$563,964 |

|

Washington |

$614,411 |

|

Massachusetts |

$653,648 |

|

District of Columbia |

$724,949 |

|

California |

$806,674 |

|

Hawaii |

$986,887 |

Keep in mind that even within the same state, prices can still fluctuate considerably. Factors such as proximity to schools, parks, public transportation, and other amenities can significantly increase the value of a property.

Moreover, homes near top-rated schools often see price premiums of 10% to 20% compared to those in less desirable districts.

Economy

Economic conditions significantly impact home prices. When the Gross Domestic Product (GDP) rises, consumer confidence typically increases, leading to higher homebuying activity.

In 2023, the GDP growth rate was around 2.1%, correlating with a 2.7% increase in home prices compared to the previous year.

Conversely, during economic downturns, like the recession in 2008 when unemployment peaked at 10%, home prices were brought down significantly. Some markets even experienced declines of nearly 30%.

Interest Rates

Interest rates have a direct impact on mortgage affordability. The buyer may not be able to afford a home even if they have the upfront cost, just because of the high monthly payments.

For example, when mortgage rates were 3.18% in early 2021, many buyers entered the market, driving up prices by around 15% that year.

In 2024, the rates have climbed as high as 7% (6.89% national average). This leap increased monthly payments on a $400,000 mortgage, for example, from around $1,686 to around $2,661.

That’s around 36% more money to spend on a mortgage per month, which can deter potential buyers.

Note: All information mentioned above is calculated based on data from Bankrate. For more, check out Bankrate.com’s mortgage rates.

Seasonal Trends

The time of the year when you purchase a house can affect its price. Historically, spring and summer months see increased activity; homes sold during these seasons can fetch prices up to 5–10% higher compared to those sold in winter months.

Bank Rate constructed a graph evaluating the fluctuations in house prices within the same year in the period between March 2020 and September 2024.

On viewing the graph, you can see that May and June are always on the climbing end of the graph, often leading to big leaps in the overall price. Conversely, the period from October to January is when prices start to drop back down.

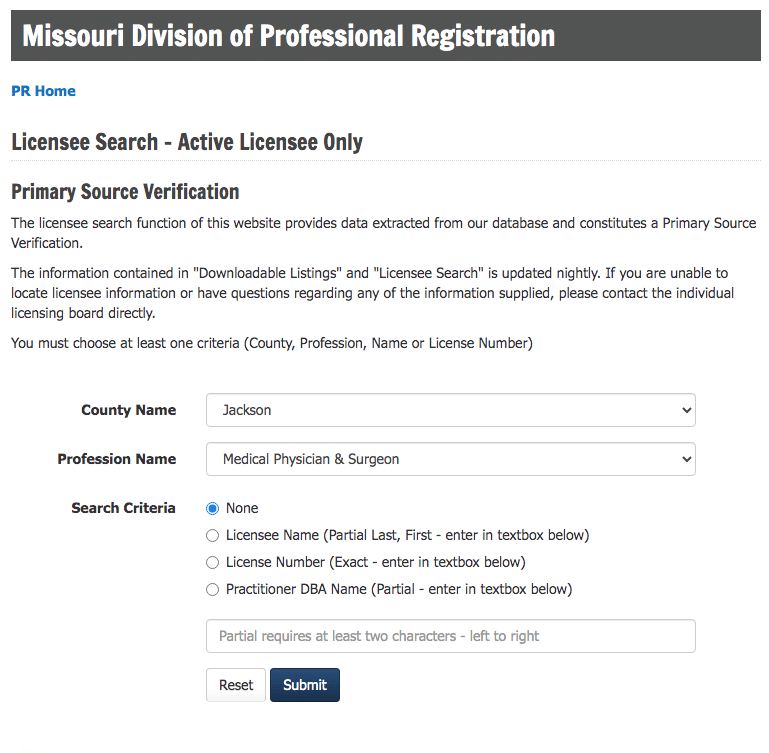

Related: Doctors Home Loans – A Guide for First-Time Borrowers

Breaking Down the House Purchase Price

There are two types of costs that you need to mind when purchasing a house: upfront costs and ongoing costs, both of which have further subcategories to consider.

Let’s begin with the upfront costs.

Upfront Costs of Home Purchase in the United States

These costs include down payment, reserves, closing costs, and, of course, moving costs.

Down Payment

The down payment is how much you initially pay. This is a lump sum that accounts for an agreed-upon percentage of the house’s price. For example, if you’re purchasing a $400,000 house and agree to pay a down payment of 10%, your initial payment will be $40,000.

The more you manage to pay upfront, the easier your mortgage and interest will be.

Reserves

You may have enough money to pay for a down payment, but that doesn’t necessarily mean the seller will immediately hand you the keys to the property. They need a form of a guarantee that you will manage to pay the monthly mortgage.

This guarantee is your reserve, which is typically a minimum of two months’ worth of payments to serve as an emergency fund.

Closing Costs

In addition to the down payment initial cost, you’ll need to pay an average of 2–5% in closing costs. Closing costs include a variety of fees and charges incurred during the closing process. They include:

- Loan origination fees: Charges from the lender for processing the mortgage application. Their average estimate is around 0.5%–1.5% of the loan amount.

- Legal fees: These are payments to attorneys for preparing documents and facilitating the closing process. You’re looking at $1000–$2000 here.

- Appraisal fee: This is the cost of evaluating the property’s market value. The estimated average is $300–$500.

- Transfer taxes: These taxes are levied by the state or local governments when transferring property’s title from its owner to you. This one varies by location.

- Title insurance: This insurance protects against potential disputes over property ownership. It costs a minimum of $300.

- Recording fees: Recording fees are charges for registering the deed and mortgage with local authorities. They can range between $50 and $200.

Moving Costs

You’re moving to a new house, so the moving costs can greatly vary depending on where the house is, how much baggage you will have, and whether you’ll hire someone to help you relocate.

Ongoing Costs of Home Purchase in the United States

Once you’re done with the initial payment and move into your house, these payments are required to keep the house:

Monthly Mortgage Payment

Monthly mortgage payments are typically the biggest ongoing expense for homeowners. This monthly payment includes both the principal and the interest on the loan. The exact amount depends on the loan amount, interest rate, and loan term.

We’ll apply the ongoing costs on our $400,000 as an example. If we assume a mortgage rate of 5% interest over 30 years, we’ll get a monthly payment of around $2,300.

Related: Bank On Yourself: How To Become Your Own Bank

Mortgage Insurance

In some cases, you may be required to pay private mortgage insurance (PMI), especially if your down payment is less than 20% of the property’s value.

This insurance is to protect the lender in case you default on your loan, and it costs somewhere between 0.3% to 1.5% of the original loan amount annually. Applying that to our $400,000 example, that’s $1200–$12,000 a year.

Homeowners Insurance

Just like car insurance, homeowners insurance is a necessary expense that protects your home and belongings from damage or loss caused by events like fire, theft, or natural disasters.

The average cost is about 0.5% of the home’s value annually. In our example, that’s $2,000.

Homeowners Association Fees (HOA)

You only pay HOA fees if your property is part of a community governed by a homeowners association. This is a private organization that governs a residential community to maintain property value.

Their fees can be monthly or annually, and they cover maintenance of common areas and amenities. It’s hard to estimate this one because they significantly vary depending on the community.

However, to give you a rough estimate, their monthly fees can range between $100–$700.

Property Taxes

Property taxes are assessed by local governments and can vary based on the property’s value and location.

These taxes are often paid monthly as part of the mortgage payment through an escrow account, but the option to pay them directly in a lump sum is also available.

FAQs

What Is a Realistic Budget for Buying a House?

A realistic budget is one where your mortgage payment doesn’t exceed 28% of your gross monthly income. A common guideline is to aim for a home price that is 2 to 2.5 times your annual income to ensure that you can comfortably manage other financial obligations.

Are There Any Government Programs to Assist First-time Buyers?

Yes, programs like FHA loans with lower down payments and USDA loans for rural properties can help first-time buyers. Additionally, many states offer first-time buyers exclusive assistance programs that provide grants or down payment assistance.

How Do I Calculate My Potential Mortgage Payment?

You’ll need to consider the loan amount, interest rate, and loan term. You can use an online mortgage calculator for this. But if you prefer to do things yourself, use this formula: M = P x divided by

. M is the monthly payment, P is the loan principal,

is the monthly interest rate, and

is the number of payments.

Closing Words

Buying a home in the United States can look a bit overwhelming in the beginning, but it all comes down to filling a few equations and ensuring that you have above the minimum financial requirements.

However, consulting a professional to do this is never a bad idea, especially if you’re a physician, which comes with additional financial obligations compared to most other professions.

These obligations can include student loans, malpractice insurance, costs of starting a private practice, and more.

To help you with that, you will need someone who is specialized in both the medical and financial aspects; that’s Physicians Thrive for you.

Contact us and let us know your individual situation, and we’ll help you take the best possible course of action.